This Week in Retail #83

Hey Friends,

Huge news this week coming in from the world of athletics and flagship launches. The M&A activity around the retail sector is starting to heat up and we look at AI tools replacing the photo studio. What does the future look like for the big tech retailers like Amazon, Alibaba and TikTok? Lets get into it

Let’s start with some sporting news…….The Los Angeles Lakers are set to undergo a major ownership change, as the Buss family—who have owned the franchise since 1979—will sell their majority stake to billionaire investor Mark Walter, according to ESPN. Walter, who already owns stakes in the Dodgers, Sparks, Cadillac’s F1 team, and several global soccer clubs, will acquire control of the team in a deal that values the Lakers at an unprecedented $10 billion, possibly rising to $12 billion. Despite the sale, Jeanie Buss will remain the Lakers' primary governor and continue to run the team for the foreseeable future. The Buss family will retain a 15% ownership stake. This record-setting valuation far surpasses recent deals like the $6.1 billion Boston Celtics sale and could reshape valuations across all professional sports. The timing coincides with the NBA’s upcoming $77 billion media rights deal, which will dramatically boost team revenues. The Lakers, one of the league’s most iconic franchises with 17 championships, currently feature stars LeBron James and Luka Dončić, although they were eliminated in the first round of the playoffs this year.

Nordstrom is growing its Nordstrom Local footprint with a new 3,000-square-foot location opening June 26 in Brooklyn’s Williamsburg neighborhood. The store will offer services like online order pickup, alterations, returns, gift wrapping, and clothing donation—but no merchandise sales. It joins two other Nordstrom Local locations in New York (West Village and Upper East Side), and three in Los Angeles.

The company also received approval to open a Local in San Francisco’s Pacific Heights, signaling renewed interest in the concept after pulling back on full-line and Rack stores in the city last year due to declining downtown foot traffic. Nordstrom sees opportunity in neighborhood-based service hubs, with execs citing strong walkability and high digital engagement in the Fillmore area.

Originally launched in 2017, Nordstrom Local was once touted as the future of the brand, but expansion slowed as the company shifted focus to Nordstrom Rack. Now, with the business going private following a $6.25 billion acquisition by the Nordstrom family and El Puerto de Liverpool, the retailer appears ready to reinvest in localized service experiences for urban customers.

A Listeria outbreak linked to FreshRealm’s chicken fettuccine alfredo meals has resulted in three deaths, one fetal loss, and 17 reported illnesses across 13 states, prompting a major health alert. The contaminated products were sold under Walmart’s Marketside brand and Kroger’s Home Chef label. Affected items include specific tray meals with best-by dates through late June 2025, and consumers are urged to check their refrigerators and discard any matching products. The outbreak strain of Listeria monocytogenes poses serious health risks, particularly to pregnant women, the elderly, and immunocompromised individuals

Last Week, Kirkland’s, Inc. announced it will rebrand as The Brand House Collective, Inc. to reflect its transformation into a multi-brand retail operator. This shift aligns with its partnership with Beyond, Inc., and encompasses key brands like Bed Bath & Beyond, Overstock, and buybuy Baby.

Key Highlights:

Rebrand & Strategy Shift: Kirkland’s aims to become a leaner, performance-led organization with a focus on brand conversions, real estate optimization, and talent upgrades.

Store Conversions: The company will convert existing Kirkland’s Home stores into Bed Bath & Beyond Home locations, starting with 6 stores in the Nashville area by August 2025, and plans to convert around 75 stores by 2026. The Overstock brand will debut in physical retail with up to 30 stores following a pilot.

New Leadership Team:

Jamie Schisler (COO) – former roles at Abercrombie & Fitch and Express.

Kerri Dlugokinski (VP, Bed Bath & Beyond Home Merchandising) – 20+ years at Target.

Courtenay Adolf (VP, Supply Chain) – experience at Target and CSS Industries.

Board Changes: Four new directors were appointed, bringing retail, strategy, and operational expertise. Five current directors, including former CEO Jill Soltau, will step down.

Name & Ticker Change: Pending shareholder approval on July 24, 2025, the company will officially change its name to The Brand House Collective and its ticker from KIRK to TBHC.

Overall, this rebrand marks a strategic overhaul aimed at consolidating retail operations, revitalizing legacy brands, and improving profitability through tighter inventory management and a focus on consumer-centric retailing.

Home Depot has reportedly made a private offer to acquire building-products distributor GMS Inc., setting up a potential bidding war with Brad Jacobs’ QXO, which recently submitted a $5 billion all-cash bid. GMS confirmed receiving QXO’s unsolicited proposal earlier this week. Both companies are aiming to expand their share of the contractor and construction supply market. GMS, which has a market value of around $3.1 billion, saw its stock surge nearly 30% on the news, reflecting investor expectations of a bidding contest. Home Depot’s interest follows its $18.25 billion acquisition of SRS Distribution last year, signaling a continued push into pro-focused retail. Meanwhile, QXO, which recently closed a major deal for Beacon Roofing, has given GMS until June 24 to accept its offer or face a potential hostile takeover. GMS’s board is currently evaluating both offers.

And yet another story outlining the significance of an effective supply chain…..The launch of NikeSkims, the collaboration between Nike and Kim Kardashian’s Skims brand, has been delayed due to production setbacks, a company spokesperson confirmed. Originally slated for a spring release, the first collection—featuring apparel, footwear, and accessories—is now expected to launch later this year. The delay stems from both teams working to perfect the product and timing. Announced in February, NikeSkims marks Nike’s deeper push into the women’s market, aiming to blend performance with style and offer training products that enhance the body’s natural form. Despite the delay, consumer interest remains high.

JD Sports has opened its newest U.S. flagship store in Las Vegas, a nearly 29,000-square-foot space at the BLVD shopping center on the Strip. This marks the U.K.-based retailer’s third flagship in the U.S., joining locations in Chicago and New York City. The store showcases exclusive product drops from major brands like Nike, Jordan, and Adidas, and features tech-forward shopping experiences including mobile checkout, QR scanning, and a stock slide system. A massive two-level LED screen faces the Strip to attract passersby.

The opening reflects JD Sports' continued push into the U.S. market, following major acquisitions of Finish Line, Shoe Palace, DTLR, and most recently Hibbett for $1.1 billion. The retailer has also deepened its partnership with Nike, expanding a connected loyalty program. JD Sports recently reported FY25 revenue of £11.5 billion ($15.4 billion), with North America now accounting for 37% of total sales.

More images and details of the opening can be found here.

The announcement last week of Prime Deal Days to take place over a 4 day stretch, has other e/retailers announcing their competitive sales events……TikTok Shop is hosting its “Deals for You Days” event from July 7 to 19, offering up to 50% off across categories and brands. As part of the event, TikTok is introducing a live price match guarantee, promising cash back to select livestream participants who find lower prices elsewhere on featured products.

The campaign comes as TikTok Shop continues to grow rapidly in the U.S., with sales more than doubling year over year. The platform leads in live shopping, surpassing QVC and HSN, with 83% of shoppers discovering new products and 70% finding new brands through TikTok, according to GlobalData research.

TikTok has expanded its e-commerce footprint globally in 2024, entering markets like Mexico, Brazil, and Europe. Its pricing initiatives align with shopper demand for exclusive livestream deals, per a recent Savings.com survey. Since its 2023 U.S. debut, TikTok Shop has hosted several branded events, including E.l.f Beauty’s Super Brand Day, with other major brands like Crocs and Makeup For Ever joining the trend.

Pinterest is expanding its AI capabilities with a new Ad Labs feature that auto-generates shoppable collages from product catalogs in minutes. Announced June 11 and showcased at Cannes Lions 2025, the tool is being tested with Macy’s, and early results show users save these AI collages twice as often as regular Pins.

The collages use AI to group products into visually appealing outfit ideas and shopping inspiration based on user engagement and behavior. The feature is designed to resonate with Gen Z and streamline creative content for brands. Pinterest plans to roll it out to more advertisers in the coming months.

This is part of a broader push into AI-powered ad tools. Pinterest also updated its Trends tool to forecast shopping behavior using AI and visual clustering, and recently partnered with E.l.f. Cosmetics to launch a selfie-based color analysis tool that recommends makeup and curates a personalized shopping board.

Pinterest continues to position itself as a curated shopping destination, blending AI innovation with celebrity gift guides, personalized wishlists, and visual search features like body type search and Lens.

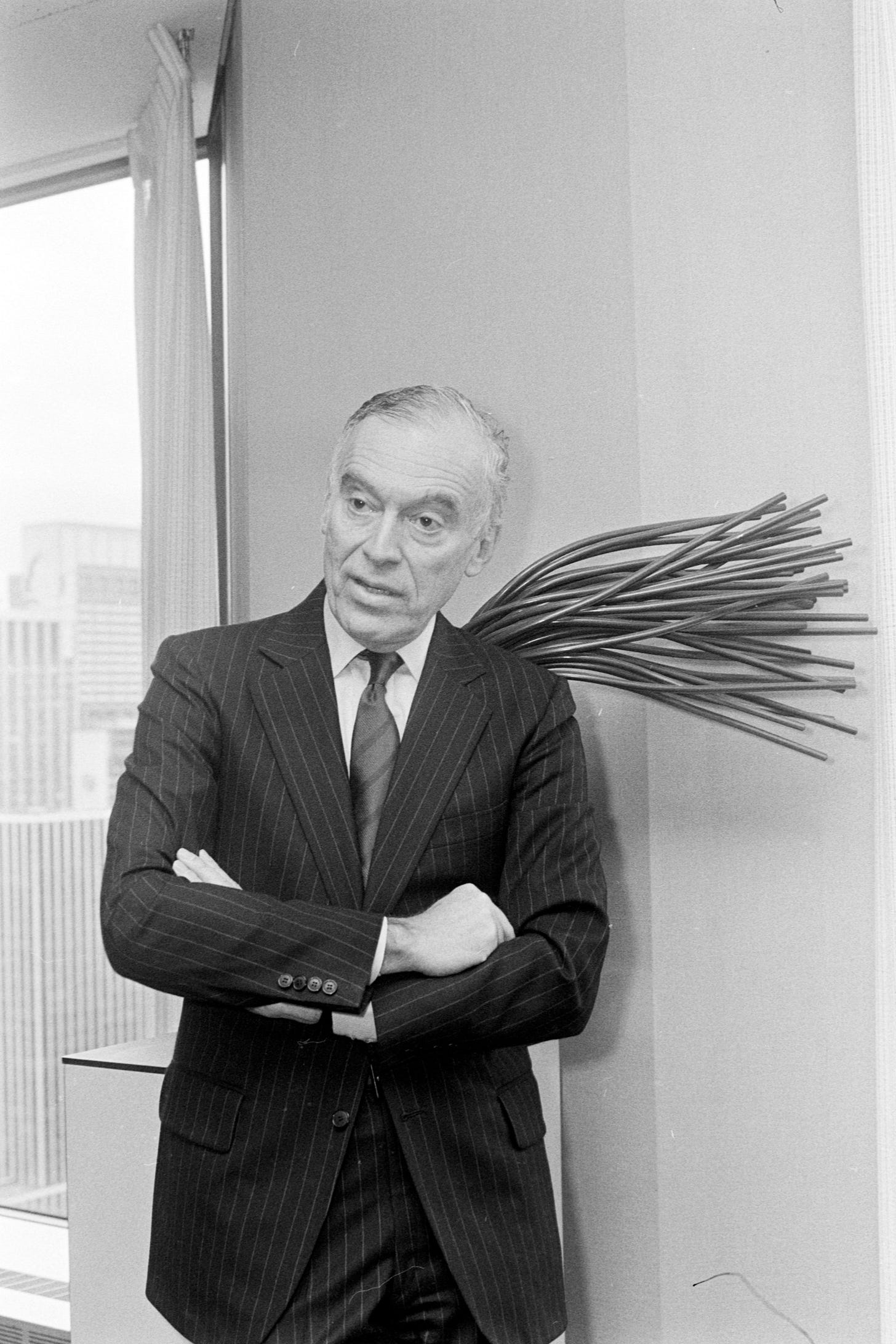

Leonard Lauder, chairman emeritus of The Estée Lauder Companies and a driving force behind its global growth, passed away last way at age 92. The son of founders Estée and Joseph Lauder, he joined the family business in 1958 and served as CEO from 1982 to 1999, remaining a key leader for over six decades.

Lauder was widely credited with shaping the modern beauty industry through innovation and a people-first philosophy. “He believed that employees were the heart and soul of our company,” said his son, William Lauder, chair of the board. Leonard’s legacy leaves a lasting impact on the company, the industry, and the family that built it.

River Island will close 33 of its 230 UK stores and is seeking rent reductions at 71 more locations at risk of closure, as part of a major restructuring plan. The move follows a sharp decline in performance, with the retailer reporting a £33.2 million pre-tax loss and a 19% drop in turnover to £578.1 million for the year ending December 30, 2023.

The company cited rising operational costs and a continued shift toward online shopping as key factors behind the closures. CEO Ben Lewis said the current store portfolio no longer aligns with customer behavior. Creditors will vote on the restructuring plan, developed with PwC, in August.

Gianfranco D’Attis will step down as CEO of Prada’s flagship brand at the end of June, the company announced Sunday. The departure, described as a “mutual agreement,” is the latest in a string of leadership changes at the Italian fashion house.

D’Attis joined Prada in 2022 in a newly created role aimed at driving the brand’s strategic evolution during a broader corporate overhaul. Prada Group CEO Andrea Guerra will assume interim leadership of the brand until a successor is appointed. D’Attis’ exit follows the transition of leadership roles previously held by Patrizio Bertelli and Miuccia Prada.

Fabletics has announced a new leadership structure to drive its next growth phase, promoting Meera Bhatia to President and COO and naming Carly Gomez as Chief Marketing Officer. Bhatia, who joined in 2020, will now oversee product development, retail, wholesale, and global operations in addition to her existing responsibilities in e-commerce, supply chain, and tech. Gomez, previously SVP of Brand Marketing, will lead brand strategy, digital innovation, and customer engagement as CMO.

CEO Adam Goldenberg credited both leaders with driving Fabletics’ rapid growth and said their expanded roles will help accelerate momentum. The brand is on track to surpass $1 billion in sales this year, with plans to grow beyond 100 stores, test new formats, and expand internationally. Last October, Fabletics entered the Mexican market through a partnership with leading retailer Liverpool, signaling its global ambitions.

Alibaba has announced it will merge its food delivery platform, Ele.me, and online travel agency, Fliggy, into its core e-commerce division as part of an internal restructuring announced last week. Let’s take a closer look at what this means:

Strategy & Objectives

CEO Eddie Wu called the move a “strategic upgrade” to shift from a traditional e-commerce company to a comprehensive, consumer-focused platform.

The integration aims to share resources, unify goals, and strengthen Alibaba's position in instant retail—a space characterized by 30 to 60-minute delivery services.

Operational Structure

Ele.me and Fliggy will keep their existing leadership (CEOs Fan Yu and Zhuang Zhuoran), but will now report to Jiang Fan, head of Alibaba’s E‑commerce Business Group—the same unit overseeing Taobao and Tmall.

Competitive Context

Alibaba is facing increasing pressure from rivals like Meituan and JD.com in China’s instant delivery and on-demand services sector.

Ele.me handles approximately 60 million daily orders, while Meituan leads with about 90 million.

AI and Consumer Experience

As part of its “instant commerce” initiative, Alibaba is enhancing Taobao with rapid-delivery features tied to Ele.me—already delivering 40 million daily orders within 60 minutes.

The integration also supports Alibaba’s broader goal to harness AI and unified data to improve user experience and prepare for future growth.

This marks a key step in Alibaba’s “1+6+N” restructuring plan from March 2023, which aims to align all consumer-facing services under a more integrated, AI-powered commerce platform.

Alibaba’s AI roadmap is central to its ongoing transformation into a more integrated, consumer-centric technology company. The company is aggressively embedding artificial intelligence across its commerce ecosystem, from product discovery to logistics. At the core is Tongyi Qianwen, Alibaba’s proprietary large language model, which powers a growing number of applications within Taobao, Tmall, and its enterprise cloud services. For example, AI is being used to generate product descriptions, recommend personalized content, and improve search relevance. On the logistics side, AI supports route optimization and instant delivery capabilities, especially as Alibaba deepens its push into “instant retail” through the integration of Ele.me and Taobao. Internally, Alibaba is also unifying data streams across its business units to fuel these AI systems with richer insights, enabling smarter inventory management, pricing, and marketing decisions. The company sees AI not just as a tool, but as the foundation for its next phase of growth—allowing it to compete more effectively with rivals like Tencent, JD.com, and ByteDance, all of whom are similarly investing in AI to redefine digital commerce and customer experience.

That’s all folks….. Have a great week!