This Week in Retail #74

Hey Friends,

This time of the year everyone’s favorite influencers are posting from the Desert. That’s right, Coachella took place last week and, as alway offers a vibrant showcase for fashion and beauty brands, featuring immersive activations and high-profile collaborations that captivated festival-goers. And where there’s a vibrant social scene, the retail partnerships follow:

Fashion Highlights

Revolve Festival

Revolve's exclusive event attracted celebrities and influencers like Charli D’Amelio and Camila Coelho. The festival featured collaborations with brands such as Hailey Bieber’s Rhode skincare and Kendall Jenner’s 818 Tequila, blending fashion with lifestyle experiences.

ENHYPEN x Prada

K-pop group ENHYPEN made a statement with custom Prada outfits, embracing a 'cowboycore' aesthetic. This collaboration marked a significant moment as they became the first K-pop act to receive custom stagewear from Prada

Beauty Activations

Fenty Beauty

Rihanna's Fenty Beauty hosted an interactive lounge offering makeup touch-ups and beauty tips, emphasizing inclusivity and self-expression.

L’Oréal Makeup Lounge

L’Oréal provided a glamorous space for attendees to receive complimentary makeup services and learn new beauty techniques from professionals.

Clinique Hydration House

Clinique introduced the "Protect Your Glow" campaign with a pop-up in Indio, California, featuring skin prep stations, SPF education, and product giveaways aimed at engaging Gen Z consumers.

Method’s Inner Shower Lounge

As the official body and haircare sponsor, Method offered a multisensory experience with interactive product displays, a hair glam station, and creative activities like painting sculptures representing their signature scents.

E.l.f. Cosmetics’ Dew Dome

E.l.f. Cosmetics created a sensorial journey highlighting their Power Grip Primer, allowing festival-goers to experience their products in an immersive environment.

Additional Brand Experiences

Pinterest’s Manifest Station

Pinterest debuted its Manifest Station, offering personalized styling sessions and trend-inspired beauty makeovers, bringing digital inspiration boards to life.

Zoeasis by Rachel Zoe

The wellness-focused Zoeasis event featured fashion and beauty activations, including Express's style lounge previewing a collection by Rachel Zoe and a brow bar by European Wax Center.

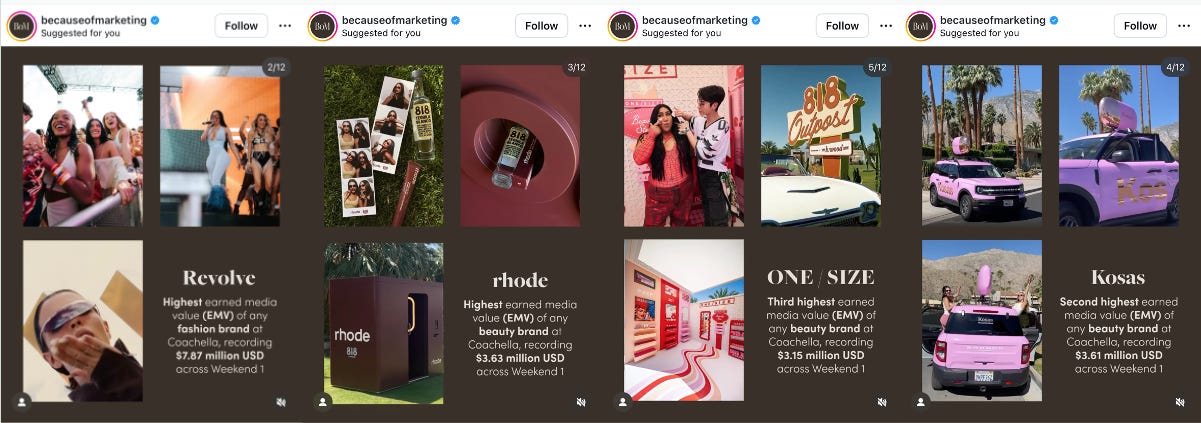

Because of Marketing did a phenomenal wrap up on the most viral marketing moments from Coachella 2025.

Some screenshots below:

Effective April 15, Under Armour has appointed Dawn N. Fitzpatrick, Eugene D. Smith, and Robert J. Sweeney to its Board of Directors, strengthening the board with deep experience in finance, sports, and retail.

Dawn Fitzpatrick is the CEO and CIO of Soros Fund Management and brings significant investment and financial leadership experience. She also serves on boards including Barclays and advisory councils at the Federal Reserve and Bloomberg.

Eugene Smith recently retired as Athletic Director at Ohio State University, where he played a major role in shaping NCAA policy and collegiate sports. He also played football at Notre Dame and has decades of leadership experience in college athletics.

Robert Sweeney is President of Sycamore Partners, a private equity firm focused on retail and consumer brands. He previously led the Consumer/Retail Investment Banking Group at Goldman Sachs and advised Under Armour on its 2005 IPO. He is also a former U.S. Navy submarine officer.

Chair of the Board Mohamed A. El-Erian said the trio’s combined financial, operational, and sports expertise will support Under Armour’s growth strategy and value creation.

Of note here, is the involvement of Sycamore Partners, the New York-based private equity firm focused on retail, consumer, and distribution sectors. Founded in 2011 by Stefan Kaluzny, the firm is known for buying and turning around struggling or underperforming retail brands, often taking them private to restructure without public market pressure.

Lets look a little closer at Sycamore……

Strategy: Buy undervalued or distressed retail brands, reduce costs, streamline operations, and improve profitability

Tactics: Often involves cost-cutting, operational overhaul, and brand repositioning; known for tough but focused turnarounds

Structure: Typically acquires full ownership and operates with a long-term investment horizon

Notable Retail Investments:

Staples

Acquired in 2017 for $6.9 billion

Sycamore split the business into three units: Staples North American Delivery, Staples Retail, and Staples Canada

The Limited

Acquired from L Brands in 2010 (prior to Sycamore’s formal launch, by Kaluzny’s earlier firm Sun Capital)

Shut down stores in 2017 but retained e-commerce operations

Belk

Acquired in 2015 for $3 billion

Filed for Chapter 11 in 2021; Sycamore retained majority ownership after restructuring

Hot Topic

Acquired in 2013 for about $600 million

Talbots

Acquired in 2012 for $391 million

Nine West Holdings

Acquired in 2014

Filed for bankruptcy in 2018; Sycamore restructured and sold off parts, including the Nine West brand to Authentic Brands Group

Ann Taylor, LOFT, and Lane Bryant (via Ascena Retail Group)

Sycamore acquired the assets of Ascena out of bankruptcy in 2020

Continues to operate these brands with a smaller, more efficient footprint

Express (in partnership)

In 2024, Sycamore partnered with WHP Global in a stalking horse bid to acquire Express after it filed for bankruptcy

The Vitamin Shoppe (pending)

In 2025, Sycamore is acquiring The Vitamin Shoppe for $193.5 million as part of Franchise Group’s bankruptcy asset sales

Sycamore has a reputation for being hands-on and aggressive in restructuring, which has led to both turnarounds and controversy. They are often seen as pragmatic operators, willing to make tough decisions—store closures, layoffs, supply chain overhauls—to save the core business.

Is there a potential partnership between Hertz and Uber brewing? Bill Ackman, CEO of Pershing Square, revealed the firm now holds a 19.8% stake in Hertz, and proposed a potential partnership between Hertz and Uber to deploy a fleet of autonomous vehicles (AVs), as reported by PMNTS and the Wall Street Journal. Ackman called the idea a “fun thought experiment” and highlighted how Hertz’s large fleet (500,000 vehicles) and global footprint could pair well with Uber’s platform to improve utilization and profitability.

Uber CEO Dara Khosrowshahi responded positively, saying Hertz has been a great partner and he’s open to brainstorming further collaboration. Hertz CEO Gil West encouraged employees in an internal note, saying they should feel energized by Ackman’s support.

Ackman noted Hertz is “uniquely well-positioned” amid rising tariffs, as an increase in used car prices could significantly boost the value of its auto assets — a 10% price hike could equal a $1.2B gain, or about half of Hertz’s market cap.

Hertz has faced recent challenges: the previous CEO resigned in March 2024 after the company sold off about a third of its electric vehicle fleet and canceled future EV purchases due to losses.

Alternatively, The Federal Trade Commission is suing Uber, accusing the company of deceptive marketing and billing practices tied to its Uber One subscription. The FTC alleges Uber:

Misrepresented savings by promoting "$25 a month" in benefits without factoring in the $10 monthly fee

Charged users prematurely or after cancellations

Made unenrolling "extremely difficult"

Uber denies wrongdoing, stating its processes comply with both the "letter and spirit of the law."

L’Oréal is partnering with Google Cloud to automate and enhance content creation using generative AI models like Imagen 3 and Gemini. This is done through L’Oréal’s CREAITECH Lab, aimed at improving creative workflows across its global beauty brands.

What they’re doing:

Generating up to 50,000 images and 500+ videos per month.

Automating content for product launches, tutorials, and campaigns tailored for different markets.

Ensuring no AI-generated human faces are used in advertising, to uphold brand authenticity and transparency.

The content will be distributed across social media, e-commerce platforms, and in-store displays.

L’Oréal is among the first major CPG companies to scale generative AI in content operations at this level.

Good news for book lovers…..After years of decline, Barnes & Noble is in the midst of a major resurgence. Under CEO James Daunt, the company has shifted its strategy by giving store managers more control over inventory and layout, creating a more curated and local feel in each location. This flexibility has allowed stores to better reflect community tastes—often boosted by viral BookTok recommendations. The retailer plans to open more than 60 new stores for 2025, up from 50 in 2024. The growth follows a strong rebound in book sales, especially among Gen Z and millennials influenced by TikTok. Barnes & Noble will focus on smaller-format stores, often in former Amazon Books or Bed Bath & Beyond spaces.

Walmart is using geospatial mapping tools to expand the reach of its delivery services by 12 million additional households in 2025.

How it works:

Using a tool called H3 geospatial indexing (developed by Uber), Walmart breaks down regions into hexagonal zones to map where and how orders can be fulfilled.

This lets Walmart more precisely assign delivery to stores, rather than relying on static ZIP code boundaries.

The data-driven approach enables multiple stores to fulfill orders in a given area, improving speed and reducing missed deliveries.

The move supports same-day delivery and Walmart+ expansion, particularly in suburbs and rural regions.

This is part of Walmart’s ongoing investment in logistics and AI to stay competitive with Amazon.

A few stories to wrap……

Walmart’s Spring Beauty Event Blooms

Walmart is going big on beauty with over 1,800 deals running through May 31. Shoppers will find savings on top brands like Olaplex, Dyson, and L’Oréal Paris. The retailer is piloting in-store Beauty Bars at 40 locations and spotlighting premium and trend-forward products online. This push builds on its Clean Beauty platform and aims to position Walmart as a go-to destination for affordable, elevated beauty.

Target Grows Private Labels, Launches Floral Brand

Target introduced Good Little Garden, a new in-house floral brand with fresh flowers and plants starting at $6. The launch is part of Target’s $15B growth strategy focused on private-label expansion. It follows the debut of brands like Dealworthy and Gigglescape. Meanwhile, store traffic has dipped following backlash to Target’s scaled-back DEI initiatives, prompting a meeting between CEO Brian Cornell and Rev. Al Sharpton.

Men’s Wearhouse Bets on American-Made Style

Men’s Wearhouse unveiled American Bespoke, a new ready-to-wear collection made in Massachusetts with designer Joseph Abboud. With suits starting at $599, the move highlights domestic production amid ongoing tariff concerns and inflation pressures.

That’s all folks….Have a great week