This Week in Retail #68

Spring of Deception

Hey Friends,

I often find this time of the year a little strange. We’re teetering on third winter/spring of deception in the Charleston area, which to me is the worst season of all. I’m not a fan of 30 degree shifts in temperature throughout the day, and coming off the backend of daylight savings time makes for a difficult Monday morning. For you sports fans, well NA sports (sorry to my International readers) this part of the year is the Bermuda Triangle - March Madness isn’t quite here, baseball hasn’t cranked up and the NHL and NBA haven’t began the post-season. Spring of deception is the theme for today. This article was drafted partly yesterday, but this felt more like a Tuesday edition.

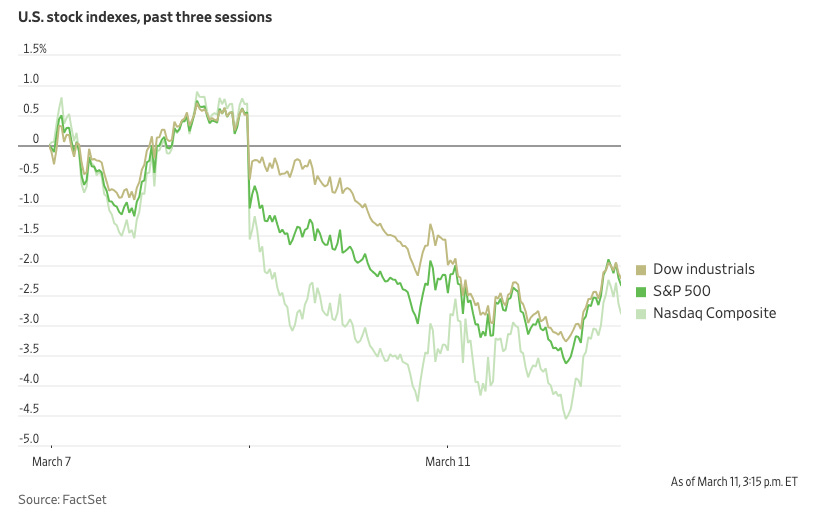

Monday wasn’t great - Stocks plunged as market anxiety over Trump’s tariff policies intensified. The Dow fell 890 points (2.08%), the S&P 500 dropped 2.7%, and the Nasdaq tumbled 4%, marking the worst day of the year for the Dow and S&P 500 and the Nasdaq’s biggest single-day drop since September 2022. Tech stocks led the decline, with Nvidia falling 5% and Palantir sliding 10%, dragging the Nasdaq into correction territory.

Wall Street’s fear gauge, the VIX, surged to its highest level this year, with CNN’s Fear and Greed Index showing “extreme fear” dominating sentiment. Bitcoin also sank to around $78,000, its lowest level since November, as investors fled risky assets.

Uncertainty over Trump’s shifting tariff policies has rattled markets all month. The S&P 500 slid 3.1% last week, its worst performance since September. Trump has threatened steep tariffs, including a 250% tariff on Canadian dairy, a “tremendously high” tariff on Canadian lumber, and a 25% tariff on steel and aluminum set to take effect March 12. While he briefly delayed a tariff on imports from Canada and Mexico, he doubled tariffs on Chinese goods to 20% and warned they could rise further.

We’re still in the middle of retail earnings season, but early reports show a mixed outlook as companies navigate economic pressures, shifting consumer spending, and inflation concerns. We’ll touch on them in more detail later but overall, a lot of “adjustments” for the remaining outlook of the year.

This Week in Retail Therapy

“It still feels like there’s something missing in the restaurant engagement space. Handheld devices have made it better, but not so much ” - James H, Ohio

I often find myself stuck in the middle between technology adoption and nostalgia, and it’s never more prevalent than when I’m eating out. I’m a huge Toast fan, and often write about my love for what they are doing to eliminate the cash register. That said there is some issues that I believe need addressing. While they succeed in getting the wait staff away from the cash register, they fall short in reliance on the service team for thing like adding on an additional margarita, closing the tab or splitting the check. I’d like to see some customer facing application integration here - for example be able to close, split or add onto my tab and have some sort of engagement through my mobile device. I also think they fall short on loyalty integrations and for someone who travels as much as I do, I would kill for the ability to manage historical receipt data outside of finding a text they sent me (or didn’t) from several weeks back. I’d also love to see a text to order feature - where that be in store or for pick-up.

I had a weird experience with an Amazon return this weekend. Perhaps this is common but it was my first experience in quite some time. When did Amazon start making you print labels for a UPS Store return? Is this common now or was this just an anomaly? I of course, tried to start this return from my phone, away from my house and had to do the song and dance of asking the UPS store to print my label for me. The “Amazombies” got a lot of bad publicity in an environment that was no box no label, I can’t imagine what the scene is going to look like when everyone is emailing the store mailbox to print their label once they get to the register.

Thank you to everyone who took me up on my call to action, sharing your retail experiences with me through the survey and the TWIR chat. If you haven’t, no worries, there isn’t a timeline, it’s there to serve as a hotline.

I’ve dropped it below for you guys.

As I said earlier, this is the season of uncertainty. The latest retail earnings reports show a mixed but cautious outlook as companies grapple with shifting consumer spending patterns and economic pressures. Abercrombie & Fitch saw a sharp drop in its stock after lowering its 2025 sales growth forecast to 3%-5%, down from 16% last year, signaling more moderate expectations. Macy’s CEO warned about ongoing "uncertainties" after announcing the closure of 150 stores, reflecting broader challenges in department store retail. Meanwhile, Target and Walmart have adjusted their forecasts due to rising costs from tariffs and inflation, underscoring concerns about profitability in the face of potential consumer pullback.

Luxury retail is also at a turning point, with brands navigating slower demand, especially in China, which has historically been a key driver of growth. While some retailers, particularly in off-price and discount sectors, continue to perform well, overall sentiment leans cautious as companies brace for an unpredictable 2025.

Foot Locker is undergoing a major store refresh aimed at improving customer experience and staying relevant in a fast-changing sneaker market. The retailer is rolling out a new store format with a more open layout, interactive digital displays, and a stronger focus on exclusive sneaker drops and localized product assortments.

The move comes as Foot Locker looks to differentiate itself from direct-to-consumer brands like Nike and Adidas, which have been expanding their own retail footprints and cutting back on wholesale partnerships. By making its stores more engaging and experience-driven, Foot Locker hopes to attract younger consumers and regain momentum after recent sales struggles.

Additionally, the company has been investing in digital and loyalty initiatives, including its FLX membership program, which offers perks and early access to sneaker releases. With store closures planned for underperforming locations, Foot Locker’s strategy is clear: fewer but better stores that offer a premium shopping experience.

A new Moody’s Analytics report by Mark Zandi highlights a growing divide in U.S. consumer spending, with the wealthiest 10% of households (earning $250,000 or more) now responsible for 49.7% of all consumer spending—the highest share on record. This group increased spending by 12% from September 2023 to September 2024, while middle- and lower-income households cut back on their purchases.

High-income earners are splurging on travel and luxury goods, with purchases on designer items, first-class tickets, and vacations rising 10% year-over-year. Reports from The Wall Street Journal, Marketplace, and Salon point to a sharp contrast between this group’s lavish spending habits and the struggles of middle- and lower-income consumers. While companies like Delta Air Lines and Royal Caribbean are seeing record demand, budget retailers like Big Lots, Kohl’s, and Family Dollar are struggling.

Real-world examples illustrate this spending divide:

One family spent $3,000 on a bike and budgeted $15,000 for a trip to India.

Another household bought a private airplane and planned to purchase a $1 million home.

A third spent $35,000 on a safari vacation in July.

With consumer spending driving 70% of the U.S. GDP, the economy is increasingly reliant on its wealthiest households. Over the past four years, the top 10% of earners have increased spending by 58%, while the bottom 80% barely kept pace with inflation, growing spending by only 25% against a 21% rise in prices.

However, this imbalance presents risks. Economists warn that a potential stock market correction or trade policy disruptions could erode the wealth fueling this spending surge.

“The risk of a significant correction in asset markets is uncomfortably high and rising,” Zandi cautioned, suggesting that any financial downturn among the wealthiest could have broad economic consequences.

As spending patterns diverge, the U.S. faces a deepening economic divide, raising concerns about long-term stability.

The U.S. Department of Justice has launched an investigation into the recent surge in egg prices, focusing on whether major egg producers have engaged in anticompetitive practices such as price-fixing or supply restrictions.

Egg prices have experienced a significant increase over the past year, with the average cost per dozen reaching nearly $5 in January 2025, compared to approximately $1.50 three years earlier. This sharp rise has raised concerns among consumers and regulators alike. The primary factor cited for the escalating egg prices is the worst avian flu outbreak in U.S. history, which has led to the deaths of over 150 million birds since 2022. This substantial loss in poultry has disrupted the supply chain, contributing to higher prices. However, some advocacy groups and lawmakers have raised concerns that certain egg producers may be exploiting the situation to artificially inflate prices beyond what is justified by the reduced supply.

Adidas has announced that it has completely sold out of its Yeezy inventory, marking the end of its partnership with rapper and designer Kanye West. The collaboration, once highly successful, was terminated due to controversies surrounding West's public statements. The company had been gradually releasing remaining Yeezy products to mitigate financial losses from the unsold inventory. With the final sale, Adidas confirms that there are no Yeezy products left in its stock, allowing the brand to move forward and focus on other strategic initiatives.

Walgreens Boots Alliance Inc. has agreed to a $10 billion buyout by private equity firm Sycamore Partners, aiming to take the company private. The deal values Walgreens at $11.45 per share, representing a 29% premium over its stock price as of December 9, 2024. Including debt and potential payouts, the transaction totals approximately $23.7 billion.

This move seeks to facilitate Walgreens' turnaround strategy amid recent struggles, providing better management opportunities as a private company through Sycamore’s retail turnaround experience. Walgreens' headquarters will remain in Chicago, and the deal will involve selling its VillageMD unit. The transaction is anticipated to close by the fourth quarter of 2025.

Forever 21 has announced layoffs, primarily impacting its corporate workforce, as part of an effort to streamline operations under parent company SPARC Group. The fast-fashion retailer has struggled with profitability in recent years, facing stiff competition from online players like Shein and Temu. While its brick-and-mortar presence remains strong, the layoffs suggest that Forever 21 is focusing on efficiency as it navigates a shifting retail landscape

Wayfair, the online home goods retailer, has announced the layoff of 340 employees from its technology team. This decision is part of a broader effort to streamline operations and achieve profitability amidst a challenging economic environment. The company has faced slowing sales growth following a pandemic-driven surge, leading to cost-cutting measures. The layoffs are expected to impact various tech roles, including engineering and product management. Wayfair aims to refocus resources on strategic initiatives that drive long-term growth and operational efficiency.

Kroger is testing new robot technology to enhance inventory management in a pilot program across 35 Cincinnati stores. The autonomous robot, nicknamed "Barney" after the company's founder, patrols store aisles to monitor product stock levels and ensure pricing accuracy.

This real-time data collection aims to improve operational efficiency and the overall shopping experience by promptly addressing out-of-stock items and pricing discrepancies. The pilot program reflects Kroger's commitment to integrating advanced technology into its operations to better serve customers.

In other grocery news…..Walmart is officially exiting Japan’s grocery market, selling off its remaining stake in Seiyu, the supermarket chain it has struggled to grow for more than 20 years. The move marks the end of Walmart’s long and largely unsuccessful attempt to break into the Japanese market, where local retailers and consumer habits have proven tough to crack.

Walmart first entered Japan in 2002, acquiring a stake in Seiyu before eventually taking full ownership. However, it faced stiff competition from well-established Japanese grocery chains like Aeon and Seven & i Holdings. Walmart’s low-price, bulk-buying model didn’t align well with Japanese shopping habits, where consumers tend to prefer fresh, high-quality, and locally sourced goods from smaller neighborhood stores.

In recent years, Walmart has been shifting its international strategy, exiting markets where it struggled (such as Germany and South Korea) and focusing on high-growth opportunities, particularly in e-commerce. The sale of its Japanese grocery business follows similar moves in the UK and Argentina, allowing Walmart to direct more resources toward its digital transformation and expansion in more profitable regions.

TikTok has expanded its e-commerce platform, TikTok Shop, into Mexico, inviting local merchants to sell products directly within the app. This move presents U.S. brands with a valuable opportunity to tap into Mexico's rapidly growing e-commerce market, especially amid uncertainties surrounding TikTok's operations in the United States. Brands like KimChi Chic Beauty, Beast Bites, and Wyze are among those exploring expansion into the Mexican market through TikTok Shop.

Social-commerce agencies such as Outlandish and Orca are facilitating this cross-border expansion by assisting U.S. brands with local business registration, logistics, inventory management, and compliance. The Mexican e-commerce sector is expected to be one of the fastest-growing globally, making this an opportune moment for brands to engage with a new customer base.

McDonald’s is ramping up its technology investments, with a strong focus on automation, AI, and digital engagement. The fast-food giant has been testing voice AI in its drive-thrus for the past few years but recently announced it is ending its partnership with IBM, which was powering its automated ordering system. While the exact reasons for the split remain unclear, McDonald’s has indicated that AI-powered drive-thru ordering isn’t ready for a full-scale rollout just yet.

Instead, the company is doubling down on other digital initiatives, including an enhanced mobile app experience, personalized promotions through its loyalty program, and dynamic menu boards that use AI to suggest orders based on factors like weather and time of day. McDonald’s has also been testing new automation technologies in its kitchens to improve order speed and accuracy.

Jack Carlson, the founder and creative visionary behind Rowing Blazers, is leaving the brand, marking a significant leadership shift for the preppy-meets-streetwear label. Carlson, a former U.S. national team rower and author of the book Rowing Blazers, built the brand on a mix of vintage Ivy League aesthetics and modern streetwear influences.

Under his leadership, Rowing Blazers gained a cult following, with high-profile collaborations featuring brands like Sperry, Babar, and FILA. The brand’s limited-edition drops and nostalgic yet irreverent take on prep fashion helped it stand out in the crowded streetwear market.

With Carlson stepping down, questions remain about the brand’s direction. Will Rowing Blazers continue in the same vein, or will new leadership take it in a different direction? Carlson has not yet revealed his next move, but his influence on the modern resurgence of preppy fashion is undeniable.