This Week in Retail #60

Hey Friends,

First and foremost, I want to take the opportunity to say that my thoughts are prayers are with everyone affected by the devastating wildfires happening in LA. My deepest condolences to the victims, as well as the first responders and communities working tirelessly to recover and rebuild.

While many of my industry friends (including me) are at NRF, it is a Monday and we’ve got stories to cover. If you’re at the show - shoot me a note, I’d love to meet you in person!

CES, dubbed the most powerful tech event in the world, took place last week. CES is the hub for innovation, blending practical solutions like with bold experiments in AI, AR, and mobility. Overall, CES was centered around "Sustainable Innovation," highlighting advancements in eco-friendly technology, AI integration, and smart solutions for everyday life. Key focus areas include climate-conscious consumer electronics, AI-driven personal experiences, and breakthroughs in health tech. This year's event emphasized collaboration across industries to tackle global challenges while enhancing connectivity and efficiency.

My favorite story of the week comes from Poshmark…..Poshmark, a leading fashion resale platform, and Loop, a commerce operations platform for Shopify brands, have partnered to help consumers resell non-returnable items easily, addressing stricter return policies and rising return costs. The initiative allows Loop merchants’ customers to list non-returnable items on Poshmark with a single click, creating a sustainable alternative to traditional returns while generating new revenue streams for retailers.

The partnership comes as holiday returns surged, with over $67.6 million in merchandise returned to Loop merchants in late December 2024, and Poshmark listings mentioning "missed return" grew nearly 50%. By integrating resale into the returns process, Poshmark and Loop aim to reduce waste, extend product life cycles, and simplify resale.

Retailers like Rothy’s have embraced the initiative, highlighting its alignment with circular fashion principles. Loop merchants can enable the feature via their returns portal, allowing consumers to create pre-filled Poshmark listings instantly.

This collaboration represents a significant step in promoting sustainability and ease of use within the fashion industry.

Probably the biggest news of the week……Ulta Beauty has appointed Kecia Steelman as its new CEO and board member, effective immediately. Steelman, who joined Ulta in 2014 and became president and COO in 2023, succeeds Dave Kimbell, who is retiring after 11 years with the company, including two as CEO. Kimbell will remain an adviser until June 28. During his tenure, Ulta grew to over $11 billion in annual revenue and strengthened its market presence.

Steelman has been instrumental in leading Ulta’s shop-in-shop partnership with Target, which has driven customer engagement and higher spending on prestige products. Under her leadership, Ulta also plans to expand into Mexico and further explore the wellness and men’s beauty markets.

Despite some recent hurdles, Ulta updated its fourth-quarter outlook, projecting modest comparable sales increases and an operating margin at the high end of expectations.

While analysts seem to responding favorably to Steelman’s appintment, they remain cautious about ongoing competitive and economic pressures as the company heads into fiscal 2025.

Ulta Beauty Announces the Launch of AI-Powered Virtual Hair Try-On. Ulta Beauty’s GLAMlab Hair Try-On is part of its broader GLAMlab suite, a virtual try-on platform that also supports makeup testing. By integrating Nvidia’s StyleGAN2 generative AI, the hair try-on feature offers unprecedented realism, capturing subtle nuances like texture, shine, and light reflection to deliver highly accurate previews. This innovation aims to reduce decision-making anxiety for customers by allowing them to experiment virtually before committing to a new look. It also aligns with Ulta’s commitment to personalization and tech-forward retail experiences, following the broader trend of blending AI with beauty retail to improve customer satisfaction and drive sales.

Lets get into some retail media news…….David’s Bridal’s acquisition of Love Stories TV is a strategic step to capture a larger share of the wedding planning journey. Love Stories TV specializes in hosting professionally created wedding videos, offering inspiration to couples while serving as a marketplace for vendors. By integrating this platform, David’s Bridal gains access to a highly engaged audience and a library of user-generated and professional content.

The launch of Pearl Media Network further solidifies David’s Bridal’s pivot toward a hybrid retail-media model. The network will leverage its digital properties and email lists to deliver targeted advertising from wedding vendors and other relevant businesses. This move reflects a growing trend among retailers—especially in niche markets—to generate revenue through retail media networks, tapping into their unique customer bases to drive advertiser interest.

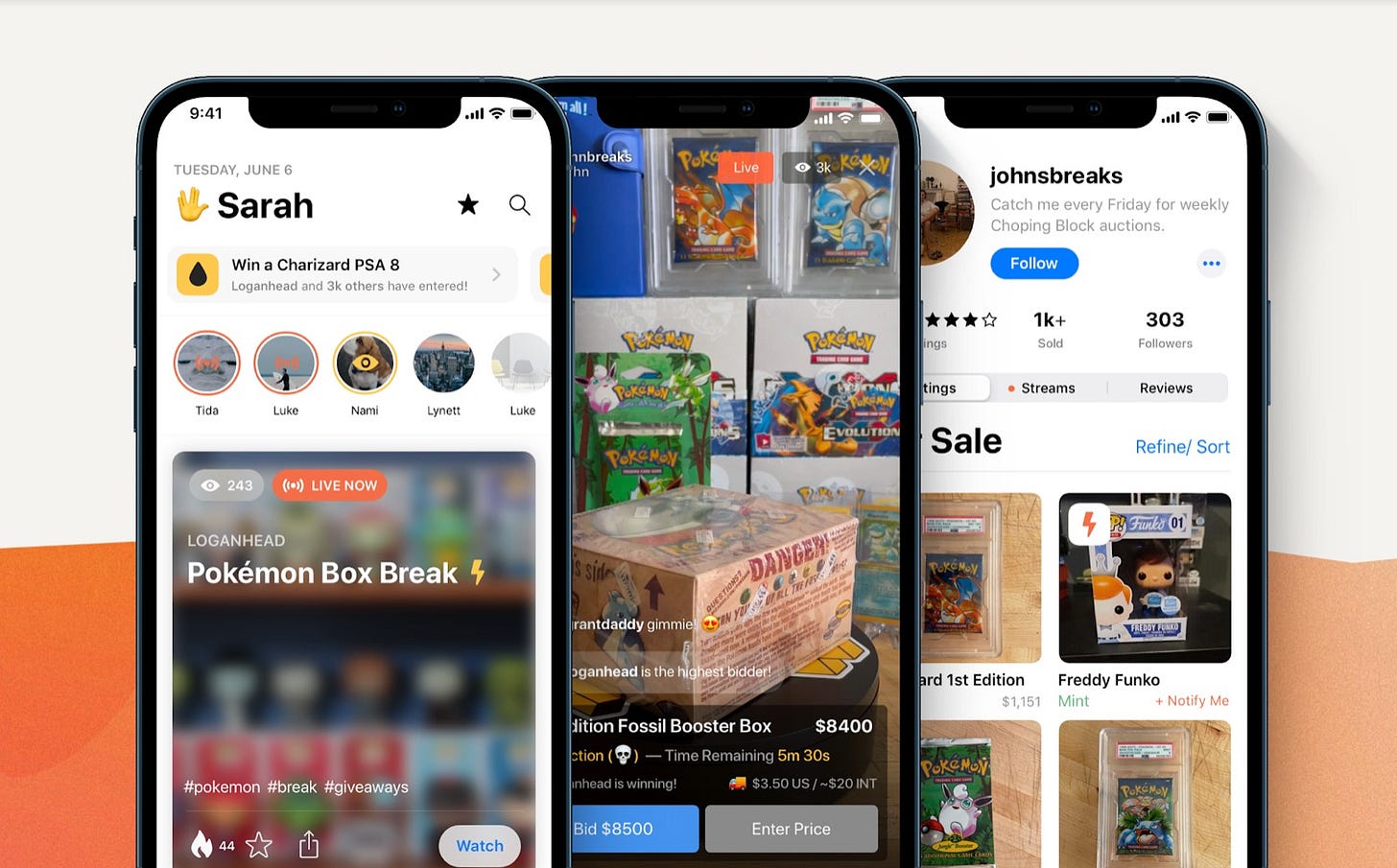

Live shopping marketplace Whatnot has raised $265 million in a Series E funding round, led by Greycroft, DST Global, and Avra, increasing its valuation to $4.97 billion. The funding will help Whatnot expand its platform, enhance seller tools, enter new markets, and invest in trust and safety measures. The company’s goal is to mainstream livestream selling by creating a platform where sellers can build businesses around their passions, fostering a community for buyers to engage and socialize. Whatnot operates in several countries and plans to launch in Australia in February. The platform hosts over 175,000 hours of livestreams weekly, with viewers spending an average of 80 minutes per day. Sales and new user growth have doubled in the past year. With live shopping gaining momentum, Whatnot’s expansion comes as TikTok faces a potential U.S. ban, potentially sending sellers to competitors.

J.C. Penney had a big week. JCPenney and SPARC Group have formed Catalyst Brands, a joint venture with over $9 billion in revenue, 1,800 stores, and 60,000 employees. The entity, backed by shareholders including Simon Property Group, Brookfield Corp., Authentic Brands Group, and Shein, has sold Reebok's U.S. operations and is exploring options for Forever 21. Led by former JCPenney CEO Marc Rosen, the new company combines six heritage brands with a focus on scale and innovation to serve American consumers.

J.C. Penney has also partnered with independent creative agency Mischief at No Fixed Address as part of its $1 billion self-funded turnaround plan. Mischief, known for its disruptive and bold marketing, will develop a new brand platform and spearhead major creative projects in 2025. This move reflects J.C. Penney’s push to modernize while staying true to its working-class heritage.

In October, the retailer appointed marketing veteran Marisa Thalberg as consulting chief brand and marketing officer to fine-tune its strategy. Thalberg, with experience at Taco Bell and Lowe’s, has positioned the changes as part of a “great American comeback story.” Mischief’s co-founder, Greg Hahn, cited Thalberg’s reputation for boldness as a key factor in the partnership.

One of the agency's initial tasks will involve showcasing J.C. Penney’s product assortment to foster a sense of discovery among customers, signaling a bolder, more innovative approach to winning back price-conscious shoppers.

Mischief's innovative and bold approach to advertising have contributed to its recognition as Ad Age A-List #1 Agency of the Year: Mischief achieved this top honor twice, first in 2022 and again in 2024.

The expiration of the UPS/USPS Negotiated Service Agreement (NSA) on December 31, 2024, has led to the immediate discontinuation of UPS SurePost for P.O. Box and APO/FPO addresses as of January 2, 2025. This has left many shippers scrambling, as USPS is the only carrier authorized to deliver to these destinations. UPS has not provided advance notice, leaving customers struggling to find alternative shipping methods.

The changes stem from USPS’s push to limit the involvement of workshare partners, like UPS, in its network. UPS appears to be shifting towards handling these deliveries in-house, similar to FedEx’s Ground Economy model, but this still leaves P.O. Box and APO/FPO deliveries without a solution.

To compensate for the increased costs of direct delivery, UPS recently raised rates for SurePost, with surcharges now aligned with Ground service levels. This has prompted concerns that rural deliveries will become more expensive, making USPS and other carriers more competitive. Many shippers are frustrated by the abrupt changes, as they were aware of the upcoming expiration but were not prepared for the immediate impact.

This shift marks a larger transformation in the shipping industry, as shippers will need to adjust to new delivery models, particularly for time-flexible e-commerce packages.

Disney and FuboTV announced a merger of their live TV streaming services, combining Hulu + Live TV and FuboTV into a single entity under the Fubo name. Disney will hold a 70% ownership stake in the new company, which will operate as a virtual multichannel video programming distributor (MVPD).

The deal resolves an antitrust lawsuit Fubo filed against Disney, Warner Bros. Discovery, and Fox over their planned sports streaming venture, Venu Sports. Originally set to launch last fall, Venu Sports was delayed after a judge issued an injunction citing potential harm to competition and consumer prices.

As part of the agreement, Disney, Fox, and Warner will pay $220 million to Fubo and Disney will provide a $145 million term loan in 2026. The merger paves the way for the launch of Venu Sports while consolidating two major live TV platforms into one.

And to wrap up……Amazon has launched Amazon Retail Ad Service, enabling U.S. retailers to integrate its ad technology into their own websites. This service allows companies to display contextually relevant ads in search results, product pages, and other site areas, with customizable design, placement, and ad volume. Retailers will pay usage-based fees, though pricing details remain undisclosed.

Amazon’s ad revenue has become a key contributor to its financial success, reaching $14.3 billion in the latest quarter—trailing only Alphabet and Meta in digital advertising. While this is still less than its online store ($61.4 billion) and cloud computing ($27.4 billion) revenues, the growth underscores the significance of its advertising business.

Most of Amazon's ad revenue stems from sponsored product ads, with additional contributions from streaming ads. The new service also includes access to Amazon's ad measurement and reporting tools, further solidifying its role as a major player in digital advertising.

Thats all folks….Have a great week.