This Week in Retail #56

Hey Friends,

Buckle up, this one will be fun.

If you have been following the Kroger and Albertsons saga (read soap opera), the most predictable thing happened this week…..Albertsons has called off its $25 billion merger with Kroger after a federal judge blocked the deal due to antitrust concerns. Following the termination, Albertsons filed a lawsuit alleging Kroger violated the merger agreement by refusing to divest assets necessary for regulatory approval and failing to cooperate during the approval process.

Albertsons accused Kroger of ignoring regulators’ feedback, rejecting viable buyers for divested assets, and engaging in “self-serving conduct” that harmed shareholders, employees, and customers. Kroger denied the allegations, calling the lawsuit baseless. This legal fallout adds uncertainty to the grocery sector as consolidation efforts face increasing regulatory scrutiny.

This story is starting to feel more like a reality show and I would expect mroe bad blood to come of this..

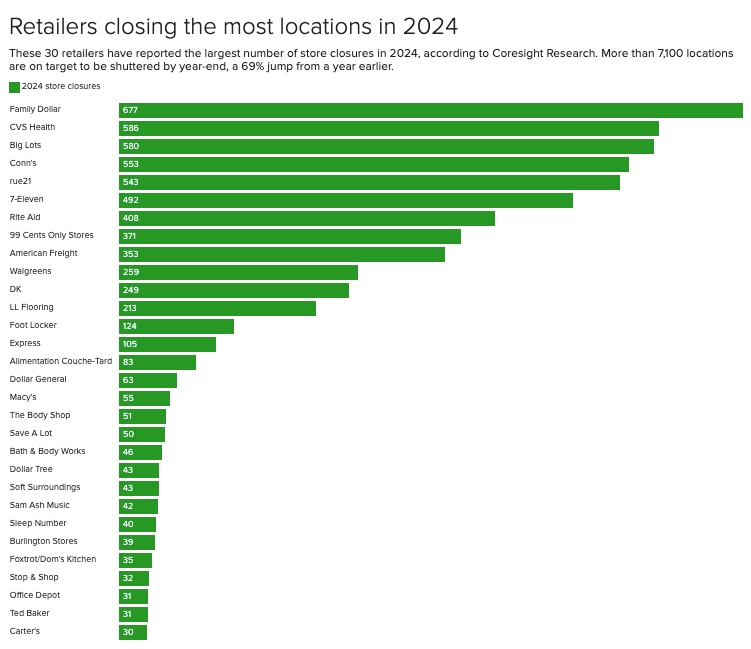

Theft and store closures continued to make headlines this week…..Retail store closures in 2024 have notably increased compared to 2023, reflecting ongoing challenges in the industry. As of late 2024, over 7,100 closures have been announced in the U.S., marking a 69% year-over-year increase. This reverses previous trends where store openings outpaced closures, a shift driven by changing consumer habits, economic pressures, and operational inefficiencies.

Topline Summary of Retail Closures by Sector (2024)

Discount and Dollar Stores: 1,154 closures

Pharmacies and Health Stores: 1,253 closures

Furniture and Home Goods: 1,119 closures

Apparel and Specialty Retail: 858 closures

Convenience Stores: 575 closures

Department Stores: 94 closures

Beauty and Personal Care: 97 closures

Groceries and Food: 82 closures

Music and Specialty Goods: 117 closures

Office Supplies: 31 closures

Retail theft in 2024 remains a growing concern for businesses. The National Retail Federation (NRF) estimates that theft, particularly from organized retail crime (ORC), cost U.S. retailers nearly $112 billion in losses in 2022, with projections suggesting it could exceed $120 billion in 2024. Organized theft and shoplifting represent significant portions of these losses, alongside other factors like return fraud and employee theft.

Shrinkage, which includes theft, accounted for about 1.6% of retailers' total sales, up from previous years. This is exacerbated by the rise in organized retail crime, which has seen a notable increase of more than 26% since 2020.

Sixth Street has invested $4 billion into a funding vehicle for Affirm, enabling the BNPL company to extend up to $20 billion in loans over the next three years. This partnership highlights the growing use of "forward-flow agreements," where private credit firms buy consumer debt from BNPL companies, providing fresh lending capacity.

How It Works: Sixth Street will purchase up to $4 billion of Affirm's loans, replenishing investments as consumers repay. This structure allows Affirm to offload debt from its balance sheet and expand lending.

Benefits: Affirm gains an alternative to public asset-backed bonds, supporting its goal of $34 billion in gross merchandise volume (GMV) by FY2025. Sixth Street accesses lower-risk debt compared to credit cards (BNPL delinquency rate: ~2%, credit cards: ~9%).

Market Growth: The U.S. BNPL sector, popular among lower-income consumers, is expected to grow from $109 billion in GMV in 2024 to $171 billion by 2029, per ResearchAndMarkets.com.

RH (formerly Restoration Hardware) reported an 8.1% increase in Q3 net revenue to $812 million and outlined plans for significant global expansion. CEO Gary Friedman announced the opening of nine new design galleries in North America and Europe next year, including locations in Montreal, Los Gatos, and London.

The company’s luxury home furnishings brand, including its Waterworks bath and kitchen line, is central to its growth strategy. RH is reducing reliance on Chinese sourcing to mitigate tariff risks and aims to achieve $20-$25 billion in global revenue annually. Recent international openings, such as its UK gallery, have shown remarkable success, with second-year growth of 42% and online sales more than doubling.

Let’s get into some retail data…….Moderate retail sales growth was reported for November, according to the CNBC/NRF Retail Monitor released by the National Retail Federation (NRF). Despite two major shopping days, Thanksgiving Sunday and Cyber Monday, falling into December and not contributing to November's totals, sales showed resilience.NRF President and CEO Matthew Shay noted that November sales built upon a strong October and would have been even higher if not for the calendar shift. Year-over-year gains were solid, with retail prices in many categories lower this year, indicating increased consumer purchasing as the economy grows. The NRF remains optimistic about its holiday sales forecast, predicting growth between 2.5% and 3.5% over 2023.Key statistics include:

Total retail sales (excluding automobiles and gasoline) rose 0.15% seasonally adjusted month-over-month and 2.35% unadjusted year-over-year in November.

Core retail sales (excluding restaurants, automobile dealers, and gasoline stations) decreased 0.19% month-over-month but increased 1.43% year-over-year.

For the first 11 months of 2024, total retail sales were up 2.15% year-over-year, while core sales rose 2.33%.

Sales performance varied across categories:

Online and non-store sales: Up 1.32% month-over-month, 21.48% year-over-year.

Grocery and beverage stores: Up 0.95% month-over-month, 5.31% year-over-year.

Clothing and accessories stores: Down 0.18% month-over-month, but up 4.21% year-over-year.

Other categories like furniture and electronics saw declines both monthly and yearly.

Overall, the data suggest a positive outlook for the holiday shopping season as consumers continue to engage with retail despite some price adjustments across various sectors.

In tech news……Apple is set to introduce satellite connectivity to its Apple Watch Ultra 3, which is expected to launch in late 2025. This feature will allow users to send and receive text messages via satellite, particularly useful in areas where cellular or Wi-Fi connections are unavailable. This enhancement aims to cater to outdoor enthusiasts and adventurers who often find themselves in remote locations.

Key Features of Satellite Connectivity

Texting via Satellite: The Apple Watch Ultra 3 will enable users to send off-grid messages using Globalstar's satellite network. Initially, the satellite feature was limited to emergency communications on the iPhone 14, but it has since expanded to allow general messaging through iMessage as of iOS 18.

Target Audience: This functionality is particularly appealing to hikers, scuba divers, and other outdoor adventurers, offering an additional layer of safety by enabling communication when traditional networks fail.

No Additional Costs: Currently, Apple does not charge for satellite connectivity on its iPhones. It is anticipated that the same model will apply to the Apple Watch Ultra 3, at least for an initial period following purchase.

Technological Advancements: The integration of satellite communication requires significant hardware improvements, including enhanced antenna systems and software optimizations. This positions the Apple Watch Ultra 3 as a leading device in the smartwatch market, potentially making it the first mainstream smartwatch with such capabilities

Apple's move into satellite connectivity for its smartwatch is seen as a strategic effort to compete with brands like Garmin, which have long offered dedicated satellite communication devices. By incorporating this feature into a popular wearable, Apple not only enhances the utility of its products but also reinforces its commitment to health and safety features in outdoor settings. In summary, the introduction of satellite connectivity in the Apple Watch Ultra 3 represents a significant advancement in wearable technology, enhancing communication capabilities for users engaged in outdoor activities and emergencies.

Wearable Fitness and Connected Technologies are leveraging aspects of a social media to gain traction. As of late 2024, Strava, the connected fitness platform, has over 135 million registered users worldwide, reflecting its significant growth and popularity within the fitness community. This number represents an increase from 120 million users reported in 2023, indicating that Strava continues to attract new athletes at a rate of approximately 2 million users per month. Fitbit Since 2010, Fitbit has sold over 143 million devices worldwide and counted around 128 million registered users and 38 million active users.

Target launched the Bullseye Gift Finder, a generative AI tool designed to help shoppers find personalized toy recommendations for kids. The tool, available on Target’s website and app, uses criteria such as age, hobbies, and favorite brands to curate tailored suggestions.

The retailer plans to expand the tool’s database with thousands of gift ideas throughout the holiday season. Target is also piloting a generative AI-powered Shopping Assistant, which answers customer questions and offers product recommendations, signaling the company’s broader efforts to integrate AI into its digital strategy.

PUMA has launched Studio48, a state-of-the-art creative hub at its headquarters in Herzogenaurach, Germany, designed to enhance design innovation and elevate the brand. Spanning 500 square meters (5,300 square feet), the facility features advanced resources like a 3D printing lab, sewing and embroidery setups, a product testing zone, and a photo studio. It serves as a collaborative space for PUMA’s internal designers and external creatives to develop performance and Sportstyle products and campaigns.

This initiative aligns with PUMA's broader strategy to sustain growth by reinforcing its sports performance credibility while infusing a distinct design language into its Sportstyle offerings. Studio48 aims to encourage tactile, hands-on creativity, complementing digital design efforts, according to Heiko Desens, VP of Creative Direction & Innovation.

The hub will also host workshops and global design events, including a recent session by upcycling artist Nicole McLaughlin on circularity. Additionally, PUMA plans to open a creative space in Los Angeles to bolster its presence in the U.S. market.

Amazon has launched Amazon Autos in 48 U.S. cities, allowing customers to browse, order, finance, and schedule pickup of a Hyundai vehicle directly from local participating dealers. The platform provides a comprehensive online car-buying experience, enabling shoppers to:

Search for available vehicles by make, model, trim, color, and features.

Get an instant vehicle trade-in valuation.

Access transparent pricing and secure financing options.

Complete the checkout process and schedule a dealership pickup.

The service streamlines the car-buying process by offering a convenient, transparent experience familiar to Amazon users. Hyundai is the exclusive launch partner, with plans to expand to other brands and cities next year. Amazon Autos also provides dealers with a new sales channel to reach a broader audience, helping them focus on building customer loyalty during the final pickup stage.

Adidas is currently under investigation by German authorities for alleged violations of tax and customs regulations. On December 10 and 11, the company’s headquarters in Herzogenaurach and other facilities were raided by Bavarian tax authorities and customs officials. The investigation focuses on compliance with import regulations between October 2019 and August 2024. Authorities are examining potential discrepancies in customs declarations and tax filings related to imported goods.

Adidas confirmed it has been cooperating with authorities for years and has provided requested documentation. The company expects no significant financial impact from the investigation at this stage. This scrutiny highlights ongoing challenges for global brands navigating complex trade and tax laws.

The U.S. Postal Service (USPS) is lowering its on-time delivery targets for First-Class Mail in fiscal year 2025, which began October 1, 2024. This decision comes after the agency failed to meet its previous on-time expectations across various First-Class Mail offerings in the previous fiscal year.

The reduction in targets varies by product:

First Class Flats: from over 90% to 80%

Presort First Class letters (overnight delivery): from 95% to 94%

This scaling back of targets indicates that the USPS is still working towards its "Delivering for America" overhaul, aimed at improving financial health and delivery reliability. Postmaster General Louis DeJoy's 10-year plan, introduced in 2021, set a goal of meeting or exceeding 95% on-time service performance across all mail and shipping products. The USPS has faced challenges in on-time delivery, particularly in areas where facility operations are being consolidated.

This has led to criticism from Congress members on both sides of the aisle. During a recent House Committee hearing, DeJoy defended the agency's progress, citing reduced transportation costs and increased revenue in competitive services. DeJoy stated that achieving 95% on-time delivery was not sustainable under the existing infrastructure and service standards. He emphasized that the current year is a transition period, with the ultimate goal of providing on-time service to all 167 million delivery points once the network is optimized.

The NYSE suspended trading of The Container Store's stock and initiated delisting proceedings after the retailer's market capitalization fell below $15 million for 30 consecutive days. The company, which has struggled with declining consumer spending on discretionary items, will not appeal the decision.

You cant spell TWIR without the FTC…….Southern Glazer’s Wine and Spirits, the largest distributor of alcohol in the U.S., is under fire for allegedly offering unfair pricing advantages to big chains like Costco, Kroger, and Total Wine & More. According to the FTC’s lawsuit, small retailers, including independent liquor stores and local grocery stores, were deprived of similar rebates and discounts, undermining their ability to compete.

The complaint accuses Southern Glazer’s of violating antitrust laws by favoring large-volume buyers since at least 2018. The distributor, which commands a 33% market share, generated $26 billion in revenue in 2023, making it the 10th-largest privately held company in the U.S. The FTC claims this practice harms consumers by reducing competition and consolidating market power among a few dominant players.

Nike secured a 10-year extension of its partnership with the NFL, continuing as the exclusive supplier of uniforms and apparel for all 32 teams. The deal reaffirms Nike’s dominance in sportswear despite earlier speculation that the NFL was considering offers from other bidders.

Nike’s role includes providing on-field uniforms, sideline gear, and practice apparel. The partnership, which began in 2012, will now run through 2038. This renewal comes as Nike undergoes a turnaround under CEO Elliott Hill, with critics urging the company to prioritize innovation to maintain its competitive edge.

The announcement listed some key initiatives between the partnership:

Global Expansion: Nike and the NFL will work together to grow the game's global reach, increasing participation, developing new talent, and expanding the football fan base.

Player Health and Safety Commitment: Nike and the NFL will leverage Nike's Sport Research Lab and product design and innovation expertise to address lower extremity injuries and enhance footwear safety.

Football Development: Nike will continue to empower the next generation of athletes and grow the sport by supporting grassroots, high school and collegiate level youth development programs across both flag and tackle football.

Storytelling and Fan Engagement: The partnership will bring football's most compelling narratives to life, connecting with fans in new and innovative ways through Nike's unparalleled marketing and storytelling expertise.

That’s all folks…..Have a great week.