This Week in Retail #48

Hey Friends,

Starting on a note of nostalgia. Kmart will close its last full-scale mainland U.S. store on October 20, located in Bridgehampton, New York. Known for its iconic “Blue Light Specials,” the retailer’s footprint has drastically shrunk over the years. After this closure, only a small store in Miami and a few locations in Guam and the U.S. Virgin Islands will remain operational. The company managing Kmart, Transformco, acquired the assets of Sears and Kmart in 2019 but has not commented on this closure.

Kmart filed for Chapter 11 bankruptcy in early 2002, becoming the largest U.S. retailer to do so at the time. It struggled to compete with Walmart’s low prices and Target’s trendier offerings, prompting the closure of more than 250 stores. At its peak, Kmart operated over 2,000 stores across the U.S., but its market presence steadily declined over the years.

Sam’s Club has introduced its first all-digital store without traditional checkout lines in Grapevine, Texas. This innovative concept leverages the “Scan & Go” app, requiring customers to scan items with their smartphones as they shop, streamlining the checkout process. The new store also features displays for online-only products, which can be ordered by scanning QR codes directly from the app.

This location, reopening after being damaged by a tornado two years ago, serves as a testbed for Sam’s Club’s digital-first strategy. While there won’t be fewer employees, staff will take on new roles to assist with the technology, such as helping customers navigate the app and manage online orders more efficiently.

In addition to Scan & Go, the store also incorporates advanced AI-based technology for seamless checkout experiences, further aligning with the trend of digital retail transformation seen in companies like Amazon. The goal is to assess the viability of scaling this digital approach across more locations.

I stumbled across the wildest story last week regarding Strava and it’s newest AI updates.

Nash Consing, a video editor, was injured in Brooklyn after crashing into a car door opened by a passenger exiting an Uber. While en route to the hospital, he logged the incident on Strava, a fitness-tracking app, only to receive feedback from the app’s new AI feature, “Athlete Intelligence.” The tool, designed to provide personalized workout summaries, responded humorously to his accident, saying, “Ouch, hope you’re okay… Keep up the great work!”

I still can’t tell if this is real or a promotion but nonetheless, I hope Nash is ok. Launched in beta last week, Athlete Intelligence aims to help newer users interpret Strava’s complex data more easily. While some users have enjoyed the feature’s humor—posting joke descriptions like “abducted by aliens” to test its responses—others see it as gimmicky and unnecessary. Strava’s Chief Product Officer Matt Salazar stressed that the tool is meant to simplify information for novice athletes, though future development plans remain vague.

Strava, which has 125 million users and strong competition from apps like Nike Run Club and Garmin, is trying to stay relevant amid the AI trend. However, some users feel the feature adds little value, while others worry it’s part of the broader AI hype without meaningful benefits.

New FTC ‘Click-To-Cancel’ Rule Will Simplify Subscription Cancellations. The Federal Trade Commission (FTC) announced a new rule requiring companies to make subscription cancellations as easy as sign-ups, aiming to curb complicated cancellation processes. The “click-to-cancel” rule, approved by a 3-2 vote, will take effect six months after its publication in the Federal Register.

This update comes in response to a rise in consumer complaints about recurring subscriptions, with the FTC averaging 70 complaints per day in 2024—up from 42 per day in 2021. The rule is part of the agency’s efforts to modernize its 1973 Negative Option Rule, targeting deceptive subscription practices. Companies that fail to comply could face civil penalties.

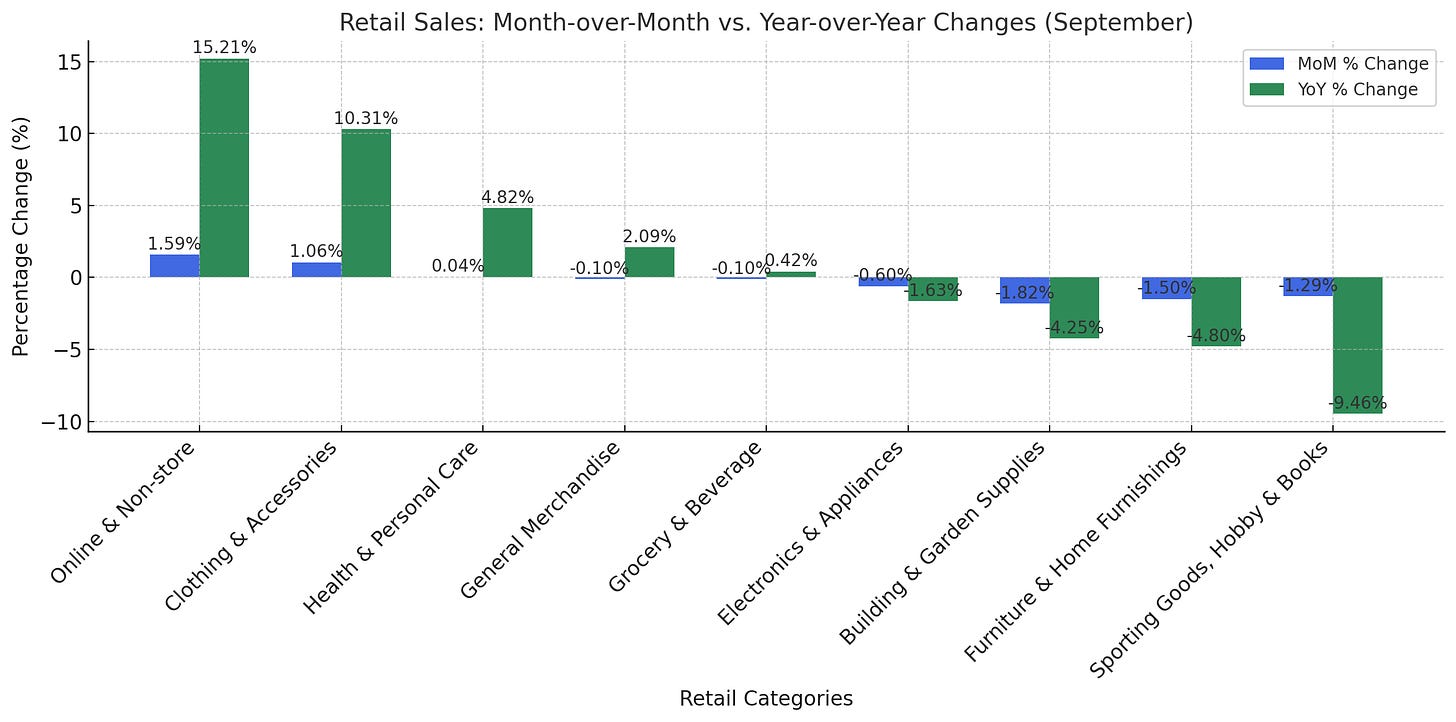

Retail sales continued to rise in September, according to the U.S. Census Bureau, driven by payroll growth, easing inflation, and falling interest rates. National Retail Federation (NRF) Chief Economist Jack Kleinhenz noted that while consumer spending shows some signs of tightening, people are still spending where they find value, helping to sustain the economy ahead of the holiday season.

Key figures:

Overall retail sales were up 0.4% month-over-month and 1.7% year-over-year.

Core retail sales (excluding autos, gas, and restaurants) rose 0.7% month-over-month and 2.4% year-over-year.

NRF forecasts 2024 retail sales to grow between 2.5% and 3.5% compared to 2023, with holiday sales expected to follow the same trend. Meanwhile, the CNBC/NRF Retail Monitor—using real-time credit and debit card data—reported a slight 0.28% dip in core retail sales month-over-month but a 0.94% increase year-over-year.

A deeper dive into the performance by category:

Online and non-store sales: +1.59% month-over-month, +15.21% year-over-year

Clothing and accessories: +1.06% month-over-month, +10.31% year-over-year

Health and personal care: +0.04% month-over-month, +4.82% year-over-year

Other sectors saw mixed results:

General merchandise: -0.1% month-over-month, +2.09% year-over-year

Grocery and beverage: -0.1% month-over-month, +0.42% year-over-year

Electronics and appliances: -0.6% month-over-month, -1.63% year-over-year

Declines were notable in home-related sectors and hobbies:

Furniture and home furnishings: -1.5% month-over-month, -4.8% year-over-year

Building and garden supplies: -1.82% month-over-month, -4.25% year-over-year

Sporting goods, hobby, and book stores: -1.29% month-over-month, -9.46% year-over-year

The National Retail Federation (NRF) also projects continued growth in holiday sales for 2024, reflecting positive consumer sentiment. Factors driving this outlook include stabilized inflation, improved employment figures, and rising wages. The NRF emphasized that the combination of in-store and online shopping will play a key role in this year’s spending trends.

This holiday season, Macy’s is introducing a curated holiday market at its flagship Herald Square location in New York, featuring local businesses. The initiative highlights Macy’s commitment to supporting small enterprises and giving shoppers access to unique, locally-sourced products. This move aligns with the broader trend of major retailers collaborating with smaller vendors to enrich in-store experiences.

After relaunching earlier this year, BuyBuy Baby announced it will close all physical stores, citing a shift towards becoming a “digital-first” brand. The company aims to focus entirely on building a superior online shopping platform. The closures mark another chapter in the retail industry’s growing pivot from brick-and-mortar operations to e-commerce.

U.S. Considers AI Chip Export Limits on Nvidia and AMD. The U.S. government is weighing the possibility of capping exports of advanced AI chips from Nvidia and AMD to certain countries, including China. These restrictions are part of efforts to protect national security and prevent advanced technologies from being used in ways that could threaten U.S. interests. If implemented, these limits could disrupt Nvidia and AMD’s revenue streams and shift the dynamics of the global semiconductor market.

Strong Discretionary Spending Boosts September Retail Sales: Retail sales in the U.S. rose in September, driven by robust discretionary spending, with consumers continuing to splurge on categories such as electronics, dining, and apparel. Despite economic uncertainties, this spending surge underscores consumer confidence as the industry enters the critical holiday season. Analysts are optimistic that this momentum will carry into the rest of Q4.

After more than a century of serving customers, Conn’s Home Plus, founded in Beaumont, Texas, in 1890, is shutting down all operations. Originally launched as Eastham Plumbing and Heating, the company was rebranded as Conn’s in 1934 by Carroll Wayne Conn, Sr., eventually evolving into a major home retailer known for appliances, furniture, and its in-house credit program.

Conn’s thrived through historical events like the Great Depression and world wars, becoming a trusted source for families needing financing options. However, the challenges of the 21st century—rising inflation, supply chain disruptions, and the COVID-19 pandemic—have proven too great.

In early 2024, Conn’s filed for Chapter 11 bankruptcy with $530 million in debt. Though initial plans included partial store closures, the company later decided to shut down all 170 locations across 15 states once inventory is sold off, expected by October. Their acquisition of Badcock Home Furniture last year, once seen as a growth strategy, instead added to their financial strain, resulting in closures for both brands.

At its peak, Conn’s employed over 4,000 people and generated over $1 billion in annual revenue, but it couldn't keep pace with online shopping trends and rising operational costs. The company's closing marks the end of a significant chapter in American retail history.

Airlines like Air France and United are racing to offer free, high-speed Wi-Fi in response to growing passenger demand for seamless internet access onboard. Air France announced plans to roll out free Starlink-powered Wi-Fi across its fleet by 2025, providing connectivity for all passengers, including those on short-haul flights. United Airlines will also introduce free Starlink Wi-Fi, aiming to offer fast service across both domestic and international routes by late 2025, with initial tests starting earlier in the year

These advancements reflect a broader industry trend of improving in-flight internet to meet customer expectations, including streaming, gaming, and real-time communication at cruising altitude. The introduction of Starlink, which uses low-orbit satellites, has disrupted the market by replacing older providers like Panasonic and Viasat on multiple airlines.