This Week in Retail #45

Hey Friends,

It feels good to be back.

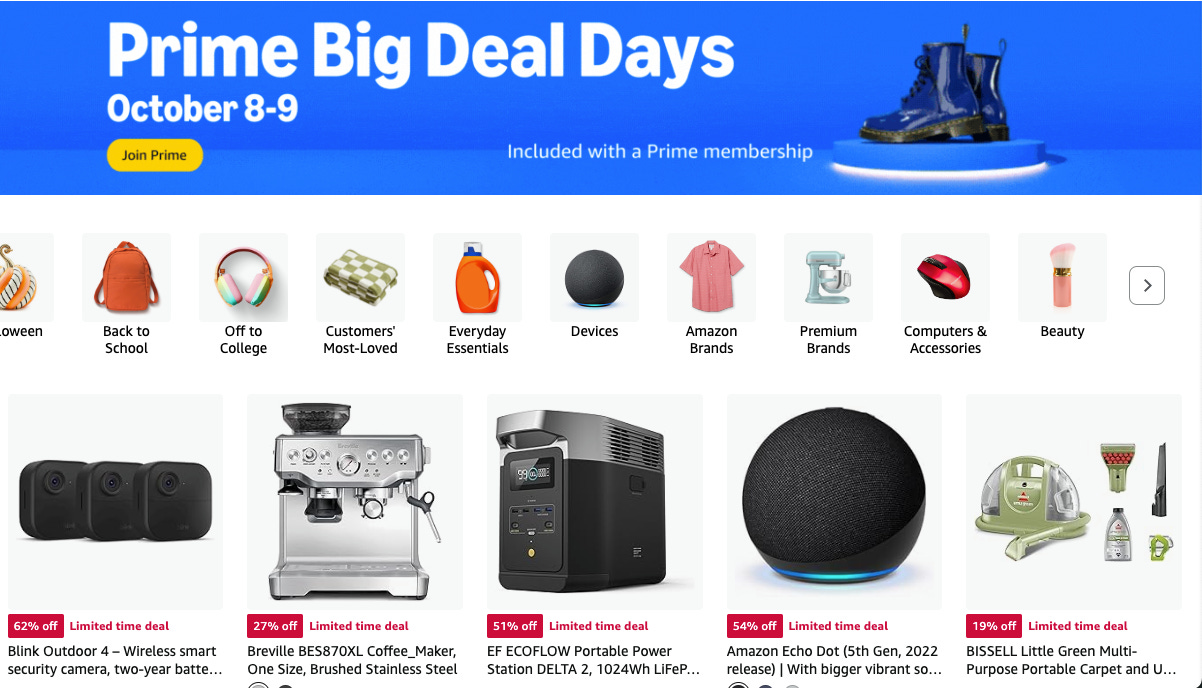

Amazon Announces Dates for Fall Prime Day. Amazon has officially revealed the dates for its second Prime Day of the year. Scheduled for October 8th and 9th, the highly anticipated event promises exclusive deals for Prime members, focusing on early holiday shopping. Retail experts are predicting a surge in sales, with many consumers looking to score deals ahead of Black Friday. Retailers should brace for increased competition and ramp up their own promotions to capture consumer attention during the event.

Amazon has hired former NBC News anchor Brian Williams to host its election night coverage on Prime Video, aiming for a non-partisan broadcast streamed from Amazon MGM Studios in Los Angeles. Williams, previously NBC’s lead anchor for over two decades, was demoted in 2015 after being caught falsifying details about his Iraq war coverage. He later hosted "The 11th Hour" on MSNBC until 2021.

Amazon is entering the news space as streaming platforms increasingly compete with traditional media outlets like NBC and CNN to attract younger audiences. With more Americans turning to streaming for news, Amazon's move reflects a growing shift away from traditional TV, supported by Pew Research data showing that 86% of U.S. adults get news from digital devices. While there's rising demand for news content on streaming, the popularity of news podcasts raises questions about whether traditional-style newscasts can succeed in this space.

Sam’s Club Raises Starting Wages. Sam’s Club has announced a significant boost to its starting pay, reflecting the continued pressure on retailers to attract and retain talent. Effective immediately, entry-level workers will see their hourly wage increase to $16. The move comes amid a highly competitive labor market, and Sam’s Club is banking on higher pay and enhanced benefits to improve employee retention during the holiday season.

A recent Gartner survey found that 32% of U.S. consumers plan to begin holiday shopping between July and October, while 29% will start in November. Despite the early shopping, only 14% plan to spend more this year, with 64% maintaining their budget and 21% planning to cut spending. Rising prices, not increased discretionary income, are the primary reason for higher spending.

Retailers like Amazon and Target are pushing holiday promotions earlier, with sales like Prime Big Deal Days and Circle Week starting in the fall. Gartner recommends CMOs plan holiday strategies early and refine them throughout the year.

Other notable trends include more online shopping, with 20% of consumers planning to increase their online purchases due to better prices. Additionally, 57% plan to use hybrid services like BOPIS and curbside pickup. Lastly, extended return policies are becoming increasingly important, especially for younger shoppers, with many favoring the flexibility of returns beyond the traditional 30-60 day window.

American Eagle Outfitters (AEO) has filed a lawsuit against Amazon, accusing the e-commerce giant of unfairly copying its product images and designs. The lawsuit claims that Amazon is using images nearly identical to those of AEO, specifically focusing on its jeans, to boost its own private-label brand. AEO argues that this violates intellectual property rights and is an attempt to mislead consumers into associating Amazon's products with AEO’s. The lawsuit reflects growing tension between traditional retailers and Amazon, especially as Amazon expands its private-label offerings.

Iconic kitchenware brand Tupperware has filed for bankruptcy after years of struggling to modernize its direct-selling model in an increasingly digital world. The brand’s storied history of Tupperware parties—once a staple of suburban America—has now given way to financial turmoil, as the company battles high debt and declining sales. Will the bankruptcy allow the brand to retool for the 21st century or is this the end of an era for the beloved product line?

Tempur Sealy International has agreed to sell 175 stores in response to an antitrust case by the Federal Trade Commission (FTC), which is set to go to trial in November 2024. This move comes as part of Tempur Sealy’s efforts to secure regulatory approval for its $4 billion acquisition of Mattress Firm. The divestiture includes 73 Mattress Firm stores and its Sleep Outfitters chain. The FTC had previously blocked the acquisition, citing concerns over reduced competition and potential price increases in the mattress market. Tempur Sealy remains optimistic about finalizing the deal by late 2024 or early 2025.

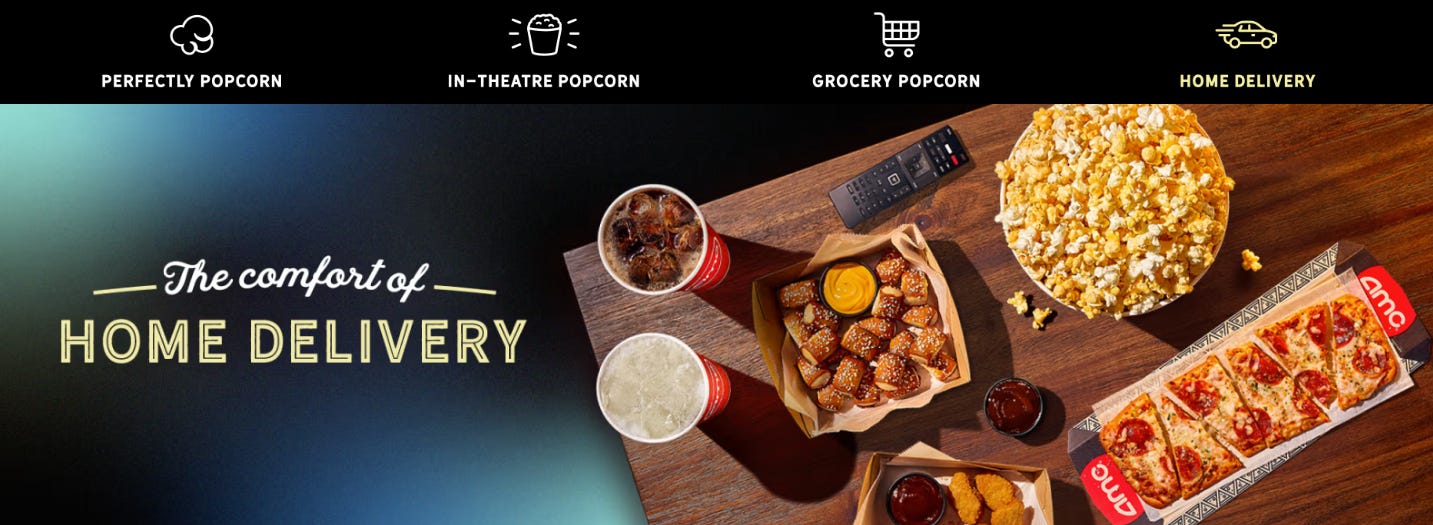

AMC Theatres is taking a unique approach to revenue diversification by partnering with Uber to offer concession deliveries straight to consumers' doors. The service will initially launch in select markets and allow moviegoers to order popular theater snacks like popcorn and candy through the Uber Eats app. This is part of AMC’s broader strategy to capitalize on its strong brand equity outside of traditional cinema settings, following the pandemic-driven rise in at-home movie viewing.

John Donahoe Exits as Nike CEO; Elliot Hill Steps In. In a surprising shakeup, Nike has announced that John Donahoe will step down as CEO, with Elliot Hill poised to take the reins. Hill, a longtime Nike executive, is expected to focus on strengthening the company’s direct-to-consumer operations and expanding its digital footprint. As the retail giant navigates a rapidly evolving market, Hill’s leadership will be critical in maintaining Nike’s dominance while adapting to new consumer trends.

Lulus is partnering with Dillard's to launch a special occasion collection in time for homecoming, with plans for a prom assortment next year. This collaboration is part of Lulus’ broader strategy to grow its wholesale business by partnering with retailers to enhance sales and margins. CEO Kristy Landsem emphasized that Lulus is focusing on expanding relationships with department stores, including three new major retailers. Dillard’s, one of the largest fashion retailers in the U.S., sees Lulus as a fresh, modern addition to its social occasion collection, appealing to younger customers.

In some AI news, OpenAI CTO Mira Murati leaves the company: Mira Murati, Chief Technology Officer at OpenAI, has announced her departure after six and a half years at the company. Murati played a pivotal role in the development of major AI products like ChatGPT. Her departure follows a period of leadership instability at OpenAI, including her brief stint as interim CEO during the company’s crisis last year. Murati stated she is leaving to explore new opportunities, although her exit surprised many at OpenAI, as it follows several other high-profile departures.

OpenAI restructuring to give Sam Altman equity: OpenAI plans to restructure from a non-profit-controlled entity to a for-profit corporation, which will allow Sam Altman, its CEO, to receive equity for the first time. This shift is intended to help the company scale and raise capital, potentially pushing its valuation up to $150 billion. The restructuring reflects OpenAI’s evolving business model as it continues to expand its commercial offerings

Google rehired an AI expert for $2.7B: Google has rehired a top AI scientist for a staggering $2.7 billion in a bid to strengthen its leadership in artificial intelligence. The individual, previously affiliated with Google, was brought back as part of its strategy to compete in the increasingly aggressive AI space, especially against competitors like OpenAI.

As someone who flies regularly for work, I’m sick of hearing about Boeing. Boeing has announced plans for temporary furloughs in its manufacturing facilities due to supply chain disruptions affecting production schedules. The company, which has faced significant challenges in recent years, is taking this step to manage costs and ensure operational continuity as it works through delayed orders. For retailers and industries reliant on Boeing's business and travel infrastructure, these delays could have trickle-down effects on supply chains and product availability.

That’s all folks….have a great week.