This Week in Retail

10.05.23

Hello Friends,

Theft, Theft and more Theft….

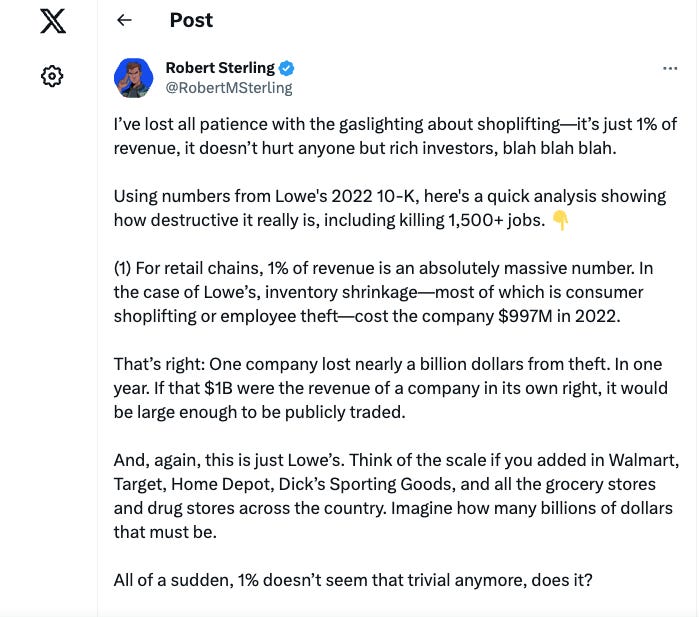

Retail theft continues to be on the forefront of retail news this week. Every article and news story related to retail seems to be addressing the growing concerns of theft and its impact on retail. Robert Sterling had the best analysis I have seen lately in the impact that theft and inventory shrinkage has put on Lowes. I have posted the thread below, but the link is considerably more in depth.

The National Retail Foundation released their annual National Retail Security Survey and of course shrink and loss are the top concerns highlighted. This year’s study found that the average shrink rate in FY 2022 increased to 1.6%, up from 1.4% in FY 2021. When taken as a percentage of total retail sales in 2022, that shrink represents $112.1 billion in losses

Officials with Target announced plans to close nine stores in four states as businesses continue to grapple with an uptick in retail crime. Breakdown by city is below:

New York City - 1

Seattle - 2,

San Francisco/Bay Area - 3

Portland - 3

Macy’s announced an approach to scale their business by getting out of the traditional mall footprint as it looks to cater to shoppers seeking more convenient locations.

The department store said Tuesday that it aims to add up to 30 new small format locations through the fall of 2025, bringing the total number of such stores to roughly 42. The next round of expansion starts in fall 2024.

RFID made some headlines this week….

Nordstrom is enhancing its supply chain optimization efforts by expanding its use of RFID technology, improving inventory productivity, and streamlining returns processing. These initiatives align with the company's priorities of boosting Nordstrom Rack performance, increasing inventory efficiency, and ultimately improving profitability for the second half of the year. These optimizations have also led to a better customer experience, with faster and cost-effective deliveries, particularly during Nordstrom's annual Anniversary sale.

Amazon announced this week that it is expanding the Just Walk Out Technology (JWO) to apparel and goods through the introduction of RFID. Customers simply enter the store, take what they like, and leave through the exit gate by using their credit or debit card, or hovering their palm over an Amazon One device. When they pass through the exit gate, the RFID tags in their clothing and other apparel are read by RFID readers, and the credit card they use to exit (or the payment information linked to their Amazon One profile) will be charged. Shortly after exiting the store, customers will be able to access their receipt at https://justwalkout.com/receipts.

The Seattle Seahawks are spearheading this effort, and was an early adopter of the technology at Lumen Field. But just how successful has JWO been? Last September, the first JWO store launched on the stadium’s upper concourse. During the 2022 season, the store saw a 60% increase in customer throughput, and the total transactions per game doubled compared to the traditional concession stand that previously stood in the same location. By the end of the season in early 2023, the team saw transactions per game in that location increase 85% and total sales per game increase 112%.

In some other Amazon headlines….

It is hard to ignore the battle between Amazon and the FTC. The FTC and 17 state attorneys contest that Amazon uses unfair practices to maintain a monopoly, including suppressing sellers offering lower-priced items in its search results, conditioning sellers to become Prime eligible, biasing search results to show preference for Amazon brands, and levying excessive fees on sellers.

While earned monopolies technically aren’t illegal, the largest question remains whether these practices (if found to be true) add up to anti-competitive practices. This will be a historic test in the government's fight with big tech.

Amazon has announced a program called "Ships in Product Packaging" that will be available for all third-party sellers using Amazon's fulfillment services in 2024. This program allows sellers to deliver items to customers in their own branded containers without any additional packaging. Amazon is currently working with select sellers on a pilot version called "Ship in Own Container" this year. The program offers benefits to sellers, including cost savings and environmental advantages, as products certified for the program can have lower Fulfillment by Amazon fees.

Let's talk about some robots….

News circulated this week that UPS and FedEx are both implementing robots to augment the unloading of packages from vehicles and trailers. This could have a huge impact on retail as these technologies become more prevalent, it could drive more uniform standards on package size. While testing is early, this could help provide improvements to the T&L industry's continued labor problem.