This Week in Retail #38

Hey Friends,

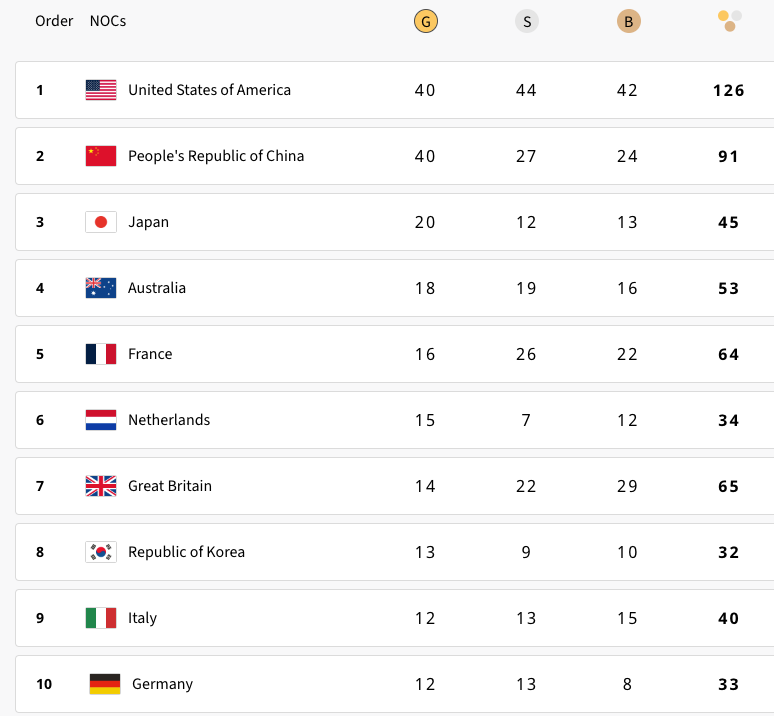

The 2024 Olympics dominated the majority of the media scene this week with the United States taking the lead with overall medal count, and sharing the top spot with China in Gold medal count. The top 10 can be seen below:

Global Brands aimed to capitalize heavily on the event. Major brands like Coca-Cola, Visa, and Toyota are official sponsors, with companies like LVMH, for example, paid nearly $160 million to obtain a premium sponsorship; one of the results is that Louis Vuitton’s leather bags will hold some of the medals and trophies. This Olympics will be Nike’s “largest media spend” yet and “the biggest moment for Nike in years.”

Companies like Reese’s, Mondelez, and Warner Brothers released Olympic-themed products, while brands like The North Face and Ralph Lauren are launching special collections. Both large and small brands, such as Nike, Adidas, Cariuma, and J. Lindeberg, are designing uniforms for athletes, with some also selling consumer versions. With over three billion viewers, brands are running Olympic-themed campaigns. NBC sold over $1.2 billion in ads, and companies like Omega are creating specialized content.

The National Retail Federation announced its list of Hot 25 retailers this week. According to the NRF, The Hot 25 Retailers ranks the nation’s fastest-growing retail companies. Rankings are determined by increases in domestic sales between 2022 and 2023; all retail companies with global sales in excess of $2 billion, and key format leaders, were eligible. I will be doing a deeper dive on this list this week, but in the meantime, the full list can be found here.

Some news coming in the grocery aisle this week…. DoorDash has expanded its partnership with Chase to incentivize grocery purchases, offering Sapphire Reserve DashPass members $10 off two orders per month and other cardholders similar discounts. This move aims to establish DoorDash as a leading eGrocery platform for Chase cardholders. Instacart is enhancing its presence in physical stores by introducing its smart cart technology, starting with Aldi South Group in Europe and a Utah grocery chain, offering personalized shopping experiences. Meanwhile, Uber Eats, Grubhub, and Shipt are also expanding their grocery services, adding more grocers to their platforms. These initiatives cater to the growing demand for both digital and physical grocery shopping options, with 52% of shoppers making purchases both online and in person.

Amazon made headlines this week for both the good and bad. The Good: Amazon’s "Just Walk Out" checkout system is getting an AI upgrade that will improve accuracy and efficiency. The new AI model will process multiple inputs simultaneously, reducing processing times. This technology, currently in use at 170 third-party locations, will be updated over the next month. The Bad: The U.S. Consumer Product Safety Commission ruled that Amazon is legally responsible for recalling hazardous products sold by third-party sellers on its platform. This decision affects over 400,000 products, including unsafe hair dryers, faulty carbon monoxide detectors, and children's sleepwear that doesn't meet flammability standards.

Big Lots, disclosed in a new SEC filing that it may close up to 315 stores due to amended credit and loan terms. Initially, the company planned to close 35 to 40 stores in 2024, but as of August 2, nearly 300 stores are now earmarked for closure. California will see the most closures, with 75 out of its 109 stores shutting down, while Texas, with 116 stores, will not experience any closures. The company has also reduced its available credit from $900 million to $800 million, with a 50 basis point increase in borrowing interest rates, and must now report more frequently to its lenders. The filing also raised concerns about Big Lots' ability to continue operating as a "going concern."

New York retail real-estate seems to still reign supreme……Uniqlo is purchasing its Fifth Avenue flagship store in New York through two separate transactions. The Japanese apparel giant is buying part of the space from a retail joint venture, where Vornado Realty Trust holds a 52% interest, and the remainder from office condominium owner Brookfield Properties. The total space covers 90,732 square feet. The deal, expected to close by the first quarter of 2025, follows a trend of retail brands acquiring their New York properties, similar to recent purchases by luxury brands like Prada and Gucci's parent company, Kering.

Vornado will use $340 million of the proceeds to repay part of a $390 million preferred equity on the property. The joint venture will retain ownership of other retail spaces on Fifth Avenue and Times Square. This transaction occurs amidst a recovery in New York's retail leasing market, with increased tourist and office worker traffic post-pandemic, as reflected in Vornado's improved retail occupancy rate.

Bloomingdale’s is partnering with Rebag to introduce in-store luxury resale kiosks, offering over 2,500 pre-owned designer items. This initiative is available both online and in select Bloomingdale's stores. This marks yet another retailer investing in second-hand and resell within it’s own footprint.

Apparently fashion and home improvement aren’t that dissimilar after all……Ace Hardware may be taking a page out of the department store handbook with its new concept. Ace Hardware is launching a new store design called "Elevate Ace," featuring store-in-store brand showrooms and enhanced customer service. The company plans to invest over $1 billion to implement this concept across its stores within the next five years.

To finish with some news in retail tech……ThredUp has introduced AI-powered search and chatbot tools designed to understand natural language and visual cues, providing customers with more personalized shopping experiences. These new features aim to help shoppers quickly find desired items among the more than 4 million items available on ThredUp's platform. The company sees AI as a significant advancement in secondhand shopping, enhancing customer engagement and sustainable shopping. ThredUp's move aligns with broader retail trends, as companies like Target, Walmart, and eBay also adopt AI technologies to improve operations and customer experience. The secondhand goods market is growing, with ThredUp predicting the U.S. used clothing market will reach $73 billion by 2028, up from $43 billion in 2023.

As always, have a great week and I’ll catch you on Thursday for this week’s edition of Here’s My Thought.