Here's My Thought

The Cash Register is Dying

Hey Friends,

The cash register is dying. Not in the sense of going away, but in the sense of it is crippled, living off of hospice, waiting for the bright light. Buzzwords like “self-checkout” and “frictionless” offer a sexy alternative and a glimmer of hope, but lets face it, are they working? Checkout is stale, and while innovations are occuring, there is just as much reverting back as moving forward.

When I look at the first cash register, the technology has evolved - but the process is identical. Sure, it doesn’t ask you to tip. but it likely involved waiting in a que and placing your items on a counter to be accounted for by the clerk,

Frictionless shopping has become the “dippin dots” of the retail world. The reference is terrible, but dippin dots were always deemed as the ice cream of the future. Self-checkout was set to reshape the retail landscape and offer one of multiple paths to line bust and create a smoother exit experience. I’m not sure that it’s the case, and as someone who works in the industry, the feedback I often get is - when it works, it’s great - when it doesn’t, its miserable. It’s no secret that consumers want more convenient ways to checkout and purchase goods in the brick-and-mortar space. As a retailer, what are you supposed to do? UPC and barcodes dictate your supply chain, inventory management process, and financial systems. Traditional scanning only has challenged self-checkout and retailers are reconsidering their reliance on self-checkout technology due to increased merchandise losses and customer dissatisfaction. Walmart, Costco, and others are adjusting strategies, with some removing self-checkout lanes altogether. Shrinkage, primarily caused by theft and scanning errors, is a major concern. Despite initial popularity during the pandemic, self-checkout's drawbacks are becoming more apparent, prompting retailers to seek alternative solutions to streamline checkout processes and improve customer loyalty. The decision by major retailers like Walmart, Costco, and Dollar General to reevaluate and in some cases reduce reliance on self-checkout reflects a broader trend in the industry.

Despite mixed opinions on self-checkouts, many retailers are adopting the technology. Some Kroger supermarkets now operate entirely via self-checkout, and Kohl's and Zara are expanding their self-checkout options. However, other retailers are reconsidering their approach, with some removing the technology or adding staff to self-checkout lanes to prevent theft.

The use of self-checkout surged during the pandemic, increasing from 15% of transactions in 2018 to 30% in 2021. The technology aims to reduce labor costs and improve efficiency, although data on its effectiveness is mixed. Some shoppers appreciate the convenience, while others prefer human interaction.

Failures and glitches in self-checkout machines are common, and the technology has not significantly reduced labor costs. For example, Albertsons and Kroger have not seen a substantial decrease in employee-to-store ratios despite adding self-checkout machines. Federal data also shows the number of cashiers in the U.S. has remained stable over the past decade, although a decline is expected by 2032.

Self-checkouts contribute to inventory shrinkage, with higher theft rates and user errors. A 2018 report found that stores with self-checkout machines experienced 31% higher shrinkage losses than the industry average, and stores with a higher number of machines saw losses 60% higher. Walmart and Costco are taking steps to address these issues, such as removing self-checkouts and increasing staff oversight.

Retailers must balance the benefits and drawbacks of self-checkout technology, considering customer preferences and the potential for increased theft and errors.

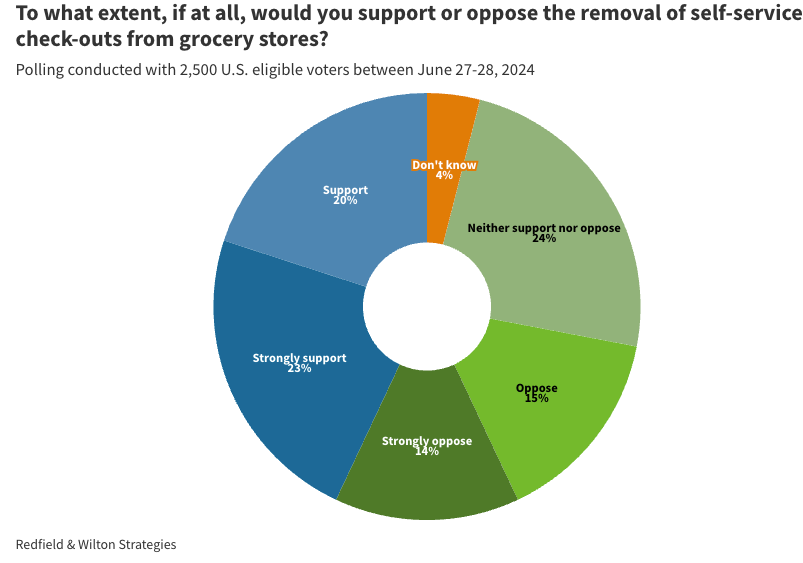

Exclusive polling for Newsweek by Redfield & Wilton Strategies shows that 43% of Americans support the removal of self-checkouts from retail stores, with 23% strongly supporting it and 20% generally supporting it. This sentiment is echoed by Grabango's CEO Will Glaser, who notes that while some shoppers appreciate self-checkouts, many do not, as they feel burdened by the task of checking themselves out. Additionally, self-checkouts are linked to increased "partial shrink," where customers pay for only part of their purchases, which negatively impacts retailer profits.

The survey, conducted in late June among 2,500 U.S. voters, found that the main reason for disliking self-checkouts is job loss (62%), followed by a preference for personal interaction (40%) and the inconvenience of machines not accepting cash (27%).

A Brief History

The automated self-checkout, or Semi Attended Customer Activated Terminal (SACAT), was developed to address inefficiencies in the traditional grocery shopping experience. Historically, grocery stores operated with clerks acting as intermediaries between wholesalers and customers, gathering, measuring, and pricing items. This model was labor-intensive and time-consuming, as one clerk could assist only one customer at a time.